Investment Planning: Retirement Glide Path

Explore smarter retirement planning beyond target date funds with a customized glide path built for your goals and risk tolerance.

The foreign exchange market is the largest in the world with an average of $7.5 trillion changing hands every day. For comparison, the average daily dollar value of transactions on the US stock exchanges is about $300 billion.

Early in my career, I worked as a Foreign Exchange Analyst at the Federal Reserve Bank of New York which had the only currency trading desk in the system. As much as I learned then and since, I still am not able to forecast currency movements. As Winston Churchill put it: “There is no sphere of human thought in which it is easier to show superficial cleverness and the appearance of superior wisdom than in discussing questions of currency and exchange.”

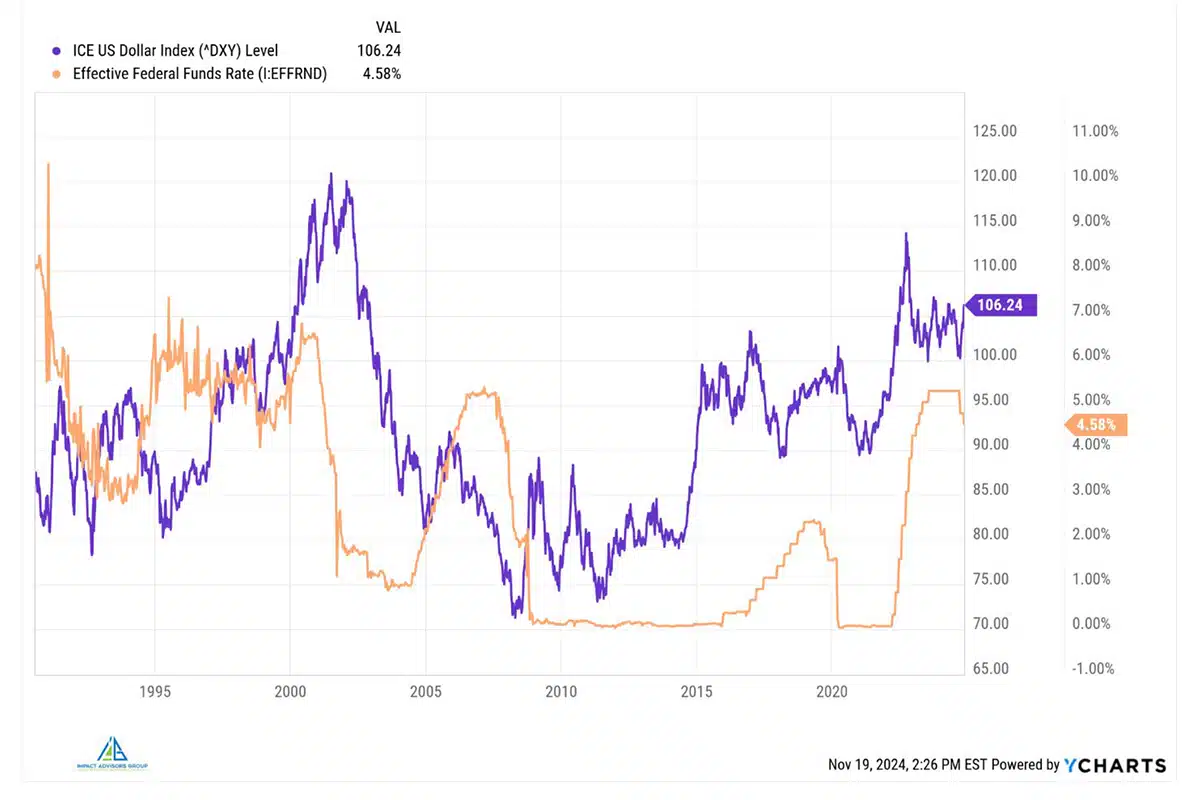

The primary influence on exchange rates is interest rates. The chart below shows the strong, but hardly perfect, correlation between the US Federal Funds rate and the US Dollar Index. Simply put, if you can earn a higher interest rate in another currency that presents an interesting investment opportunity. Back in the early 1990s US Treasury Bills were yielding about 4%, but in South Korea they were 19%. You might be willing to accept a little bit of currency depreciation to capture such a high return. In fact, there was economic research that posited that the decline in exchange rates in these high-interest rate countries was not enough to offset the gain on holding the higher yielding currency. However, sometimes these high-yielding currencies would have a very sharp depreciation. One friend described this strategy as “picking up pennies in front of a steamroller.”

A strong dollar makes foreign goods cheaper, like the French and Italian wines that I enjoy, but makes it harder for exporters to sell abroad as their goods are more expensive. Because the US dollar is the world’s reserve currency, it enjoys an “exorbitant privilege” which mostly means that we can borrow more cheaply that we would otherwise be able to do. The CFA Institute just published a survey in October 2024 on where the dollar may go in the future called: “The Dollar’s Exorbitant Privilege”. 63% thought that the US dollar would lose its reserve currency status. In part this is because 61% thought that the US would not be able to reduce its debt-to-GDP ratio which has soared from 31% in 1981, to 63% in 2007, and up to 123% today.

I don’t have a crystal ball, but the odds have risen that foreigners will start demanding a higher return to invest in our bonds.

Explore smarter retirement planning beyond target date funds with a customized glide path built for your goals and risk tolerance.

Thoughtful planning creates confidence. Prepare your finances, career, and family goals for a stronger, more focused 2026.

Before you invest, protect your plan. Discover how Matt Williams uses protection-first planning to build stronger, more resilient financial strategies.

Discover how financial organization and comprehensive planning can protect your family, reduce stress, and create lasting peace of mind.