Financial Planning: Lessons from Warren Buffet

Warren Buffett recently announced he will be stepping down as CEO of Berkshire Hathaway at the end of the year.

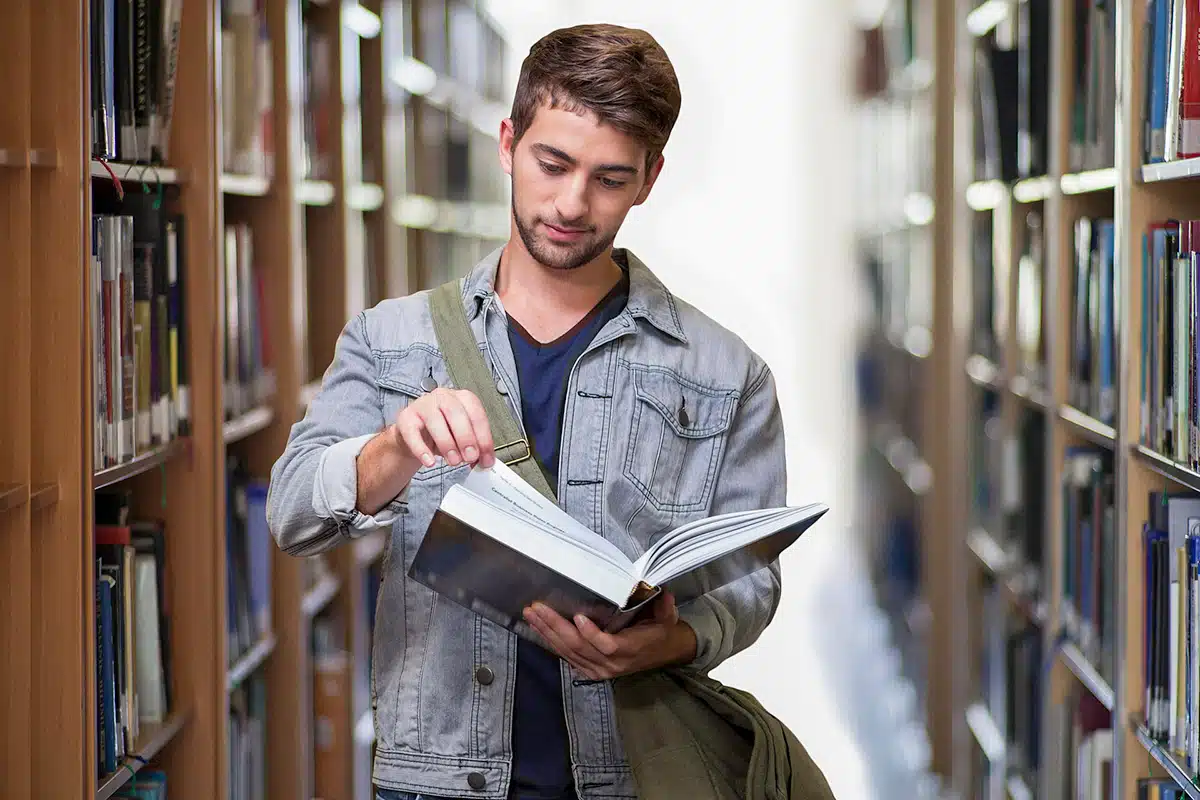

For some time now, the cost of a college degree has been rising at perilously high rates. As a result, the dream of one day going to college, for many, remains just that… a dream. With college costs rising so dramatically, it’s no surprise that people are looking for new ways to save for these expenses.

One such alternative method involves the use of a Roth IRA over more traditional college savings vehicles, such as 529 plans and Coverdell education savings accounts. That may sound bizarre. After all, why would anyone use a retirement account to save for education expenses when there are special accounts specifically designed to help plan for education costs? Here are some reasons why it may not be as crazy as you think.

When a child goes to college, if the family wants to receive student aid, the filing of a Free Application for Federal Student Aid (FAFSA) is pretty much a must. There are well over 100 questions on the FAFSA form, many of which are financial in nature and designed to help calculate what’s known as the “expected family contribution” (EFC). The EFC is essentially the amount that Uncle Sam thinks a person should pay for their own education and is calculated, in part, based on the assets of a student and their parents.

When reporting assets on the FAFSA form, most assets, including 529 plans, are included in the calculation. That means by doing the “right” thing and diligently saving for a child’s education in a 529 plan (a plan expressly designed for that purpose) could end up increasing your EFC, reducing or eliminating the amount of financial aid for which you would otherwise qualify. That doesn’t seem fair, but don’t blame me. I don’t make the rules.

On the other hand, Roth IRAs, along with other retirement accounts, are not considered assets when determining a family’s EFC. There’s no cap to that amount either, so you may actually be able to accumulate significant sums in your Roth IRA and still qualify for student aid for your child.

As noted above, 529 plans are expressly designed for accumulating money that will be used to pay qualified education expenses, like college tuition. To encourage people to contribute money to such an account, Congress created special tax breaks. As long as 529 plan distributions are used to pay qualified education expenses, distributions are 100% tax free (in some states, you may also be entitled to a state income tax deduction). So, for example, if you contribute $5,000 to a 529 plan and it grows to $20,000 by the time your child goes to college, the full $20,000 can be distributed tax and penalty free (provided it’s used to pay qualifying expenses).

That all sounds great, and it is, but if for some reason the funds in the 529 plan are not used for qualifying expenses, distributions can go from being tax free to being quite pricey. In addition to owing income tax on any gains, such distributions are assessed as a 10% penalty. True, a 529 plan set up for one child’s benefit can be transferred to an account for another qualifying family member, but such a person does not always exist.

For obvious reasons, you are often encouraged to start saving for college as early as possible. How are you supposed to know for sure though, if your five-year-old child is going to go to college? Or what if, dare I even say it, your child gets a scholarship? That could turn a tax-efficient account into a tax nightmare. If, instead of saving money in a 529 plan, you had saved the same money in a Roth IRA and no longer needed those funds for education, it’s an easy and tax-efficient transition to use those funds in retirement. If you actually do need to use the funds to pay for a child’s college expenses, the Roth IRA may even provide the same tax efficiencies as a 529 plan… which brings us to our next point.

The primary purpose of contributing funds to a 529 plan is to enjoy tax-free distributions for education purposes, but a Roth IRA often provides the exact same tax benefits. If you are over age 59½ at the time you take distributions from your Roth IRA and you’ve had a Roth IRA for five years or longer, then anything you take out of your Roth IRAs will be 100% tax and penalty free. That’s true whether you use the funds for education-related expenses or for any other purpose. With shifts in societal trends and more people waiting to get married and have children, it is increasingly common for education-related expenses to be incurred after passing the thresholds of five years and 59½ years of age.

Even if you are not age 59½ (or have not met the required holding period) at the time education-related expenses need to be paid, you may still be able to take funds out of your Roth IRA tax and penalty-free. Roth IRA contributions can be distributed at any age, and at any time, 100% tax and penalty free. So, for instance, if you contribute $5,000 per year to a Roth IRA for the next 10 years before your child goes to college (and take no distributions in the interim), at the very worst, you’d be able to take $50,000 tax and penalty free from your Roth IRA.

In addition to Roth IRA contributions, amounts converted to a Roth IRA may also be able to be distributed tax and penalty-free. Even if you are under age 59½, Roth IRA conversions can be withdrawn tax and penalty-free as long as the conversion took place five years ago or longer. So, for example, if you convert $100,000 to a Roth IRA today at age 50 and need to take that $100,000 out in six years to meet education expenses, the entire amount will be tax and penalty free. And, if you wait until age 59½, any gains you earn on that $100,000 while it is in your Roth IRA will also be able to come out tax and penalty-free. That’s a pretty sweet deal!

Now if college planning is really your thing, right about now you might be thinking to yourself, “But wait! If I use my Roth IRA to pay for my child’s education expenses as they are incurred, won’t that impact their aid in future years?”

The answer to that question is generally yes. If you take a distribution from your Roth IRA to pay for a child’s college education this year, it could definitely impact the aid they are eligible to receive in future years… but all is not lost! There’s a clever workaround for this problem that comes with many of its own benefits. Simply take out loans, or have your child take out loans, to pay for educational expenses as needed, and then, later, use Roth IRA distributions to help pay off that debt. There are several advantages to this approach, including:

Help maintain financial aid eligibility throughout a child’s education. Although your Roth IRA isn’t counted as an asset for FAFSA purposes, if you take a distribution from your Roth IRA, it will be counted as income for FAFSA purposes, even if it’s a tax-free distribution. So, if you use a Roth IRA to save for a child’s college education, everything will probably be fine the first year you fill out the FAFSA form, because you will not yet have taken a distribution to pay for any college-related costs. However, if you take a distribution from your Roth IRA to help pay tuition or other expenses for your child’s first year of college, it might reduce or eliminate their eligibility for aid in future years.

If, on the other hand, you use student loans to pay for education expenses, you can wait until your child no longer needs to file a FAFSA form for aid and then use distributions from the Roth IRA to help repay those loans.

You may be entitled to a deduction. In many cases, the interest paid on student loans is a deductible expense. If you take out a student loan for a dependent child, you can deduct the interest you pay on those loans as an above-the-line deduction on your federal tax return. As an above-the-line deduction, it is not impacted by the so-called “3% haircut.” The deduction can be reduced or eliminated, however, if your income exceeds certain thresholds. In 2022 the phase-out range for single filers is $70,000 to $85,000 and $145,000 to $175,000 for married couples filing joint returns.

Help your child build credit. In today’s world, a person’s credit score is incredibly important. Establishing and maintaining good credit can help people pay less when they buy a car and, more importantly for many, purchase a home. In fact, the difference between having good credit and bad credit, or even just average credit, can amount to many thousands, if not hundreds of thousands of dollars over the course of a lifetime.

If your child takes out student loans and consistently makes timely payments, it can really help boost their credit score.

Bonus benefit: Leverage. With any luck, when you send your child off to college, they will be motivated to study hard, get the best grades possible and make themselves an attractive target to future employers in an increasingly competitive labor market. Then again, that doesn’t exactly sound like the priority list for many 18-year-olds. Cue an added benefit of this education planning strategy that some will absolutely love: It’s what you might call the good grade leverage.

“You’re going to take out the loans to pay for your college expenses. However, as long as you maintain at least a B average (or whatever grade point seems reasonable to your clients), your father/mother and I will help you pay back those loans when you graduate.”

If your child doesn’t keep up their end of the bargain, you don’t have to feel as though you’ve thrown out money on an education your child didn’t value. Of course, it’s unlikely such a promise will turn a would-be “slacker” into an A-student overnight, but there’s definitely something to the idea of taking things more seriously when you have some of your own money at stake.

So as you can see, there are certainly more than a few reasons to at least consider a Roth IRA as a savings vehicle for a child’s education. That said, this is just one of many potential planning strategies that can help you efficiently save for a child’s education. Ultimately, every situation is different and you should always evaluate all of your potential options to see what’s best for you.

FREE FINANCIAL ASSESSMENT

With all the uncertainty and volatility in today’s economy, the time is now to take a thorough look at your finances. To accurately plan for your financial future, you must first know where you currently stand. For these reasons, our Success Team at Impact Advisors Group is offering a free financial assessment for both individuals and business owners. Request yours today!

This post was written by Jeffrey Levine, CPA/PFS, CFP®, CFP®, MSA and first distributed by Horsesmouth, LLC. Jeffrey Levine, CPA/PFS, CFP®, CFP®, MSA is the President of Fully Vested Advice, Inc. He is an expert in IRA distribution planning and is a consultant for both advisors and clients. Jeffrey has appeared on CNBC, CBS and Public Television, and is frequently quoted in publications throughout the country.

License #5349186 (Reprint Licensee: Matthew Williams, Impact Advisors Group)

IMPORTANT NOTICE: This reprint is provided exclusively for use by the licensee, including for client education, and is subject to applicable copyright laws. Unauthorized use, reproduction or distribution of this material is a violation of federal law and punishable by civil and criminal penalty. This material is furnished “as is” without warranty of any kind. Its accuracy and completeness is not guaranteed and all warranties expressed or implied are hereby excluded.

Impact Advisors Group LLC (“[IAG]”) is a registered investment advisor offering advisory services in the State of Massachusetts and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The information on this site is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This information should not be relied upon as the sole factor in an investment making decision. Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal any performance noted on this site. The information on this site is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Impact Advisors Group disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose. IAG does not warrant that the information on this site will be free from error. Your use of the information is at your sole risk. Under no circumstances shall IAG be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided on this site, even if IAG or a IAG authorized representative has been advised of the possibility of such damages. Information contained on this site should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.

Warren Buffett recently announced he will be stepping down as CEO of Berkshire Hathaway at the end of the year.

Smart investing starts with a plan. Learn why asset allocation, not stock picking, drives long-term portfolio performance.

80% of a company’s results are often created by 20% of their team, but what happens when those key employees leave?

IAG is proud to announce that Matthew Williams has been awarded the Accredited Estate Planner® (AEP®) designation.