Investment Planning: Retirement Glide Path

Explore smarter retirement planning beyond target date funds with a customized glide path built for your goals and risk tolerance.

Author: Jon Bock, CPA/PFS, CEPA®, Candidate for CFP® Certification | Director of Tax Planning at Impact Advisors Group

Should you do Roth conversions?

You want a definite answer, it should be easy to know, right? Unfortunately, the always present “it depends” is the real answer.

We will cover the strategic use of Roth conversions as a tool that could maximize your wealth and minimize your taxes. This powerful vehicle could be beneficial to you.

Roth conversions could be a great tool to possibly reduce your lifetime tax bill, but the reality in personal finance; there are no guarantees.

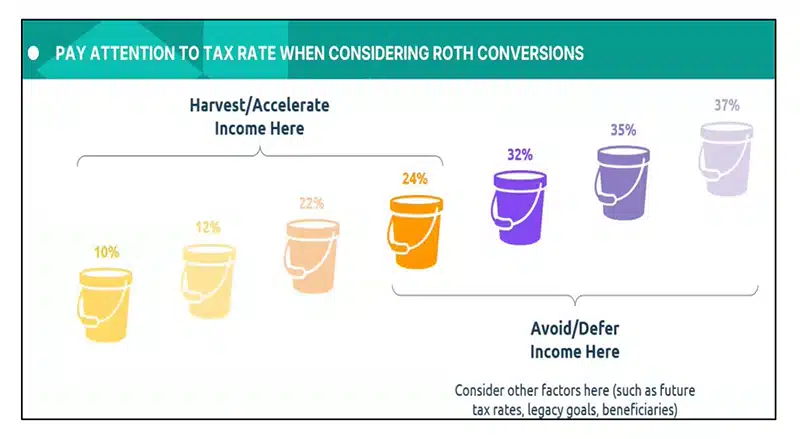

To start with we need to consider your current and future tax rates:

This graphic from Kitces highlights the current tax rates and how to use that information to begin a framework of tactically thinking about your tax rates before the implementation of Roth conversions.

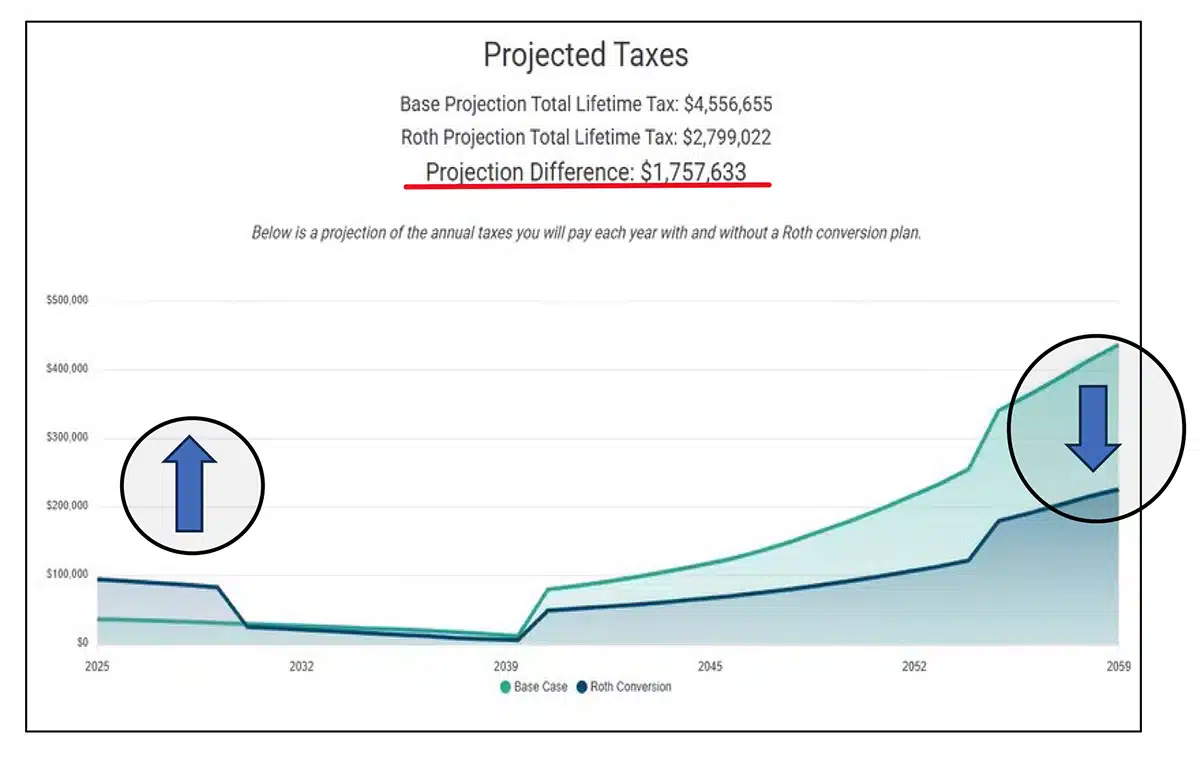

Next, I’ll show you how this strategy could be advantageous for some families. Here, the execution of a Roth conversion strategy could save this family over 7 figures in taxation. Please note the initial pain of higher taxes paid early in the execution of this strategy.

So, to keep up with Shakespeare as it relates to Roth – There is nothing either good or bad, but thinking makes it so.

We can walk you through your own personal scenario and show you a projected amount of lifetime taxes that you could save. But the analysis may also show that you may not benefit from conversions just as well.

The point is if you haven’t done the work with a professional, you will never know if there are tax savings waiting for your taking. Do you want to miss out and overpay?

Reach out to us if you would like to explore the strategic use of Roth conversions and get clarity on its benefits to you and your family.

Explore smarter retirement planning beyond target date funds with a customized glide path built for your goals and risk tolerance.

Thoughtful planning creates confidence. Prepare your finances, career, and family goals for a stronger, more focused 2026.

Before you invest, protect your plan. Discover how Matt Williams uses protection-first planning to build stronger, more resilient financial strategies.

Discover how financial organization and comprehensive planning can protect your family, reduce stress, and create lasting peace of mind.