Business Planning with Purpose, Confidence, and Alignment

Thoughtful planning creates confidence. Prepare your finances, career, and family goals for a stronger, more focused 2026.

Author: Chris Steward, CFP®, CFA®, RICP®, M.A. (CANTAB) | Director of Investments at Impact Advisors Group

In Aviation a glide path represents a stable 3-degree descent to the runway to ensure a stabilized approach to a landing. Most avionics also provide lateral guidance to ensure that the plane remains aligned with the centerline of the runway. Standard GPS equipment is accurate to about 10-23 feet, which is enough for most situations. However, when precision landing systems guide you to 200 feet above the runway a 5-12% margin for error doesn’t cut it. So for precision instrument approaches with GPS it relies upon ground-based systems to boost the accuracy of the signal to about 3 feet.

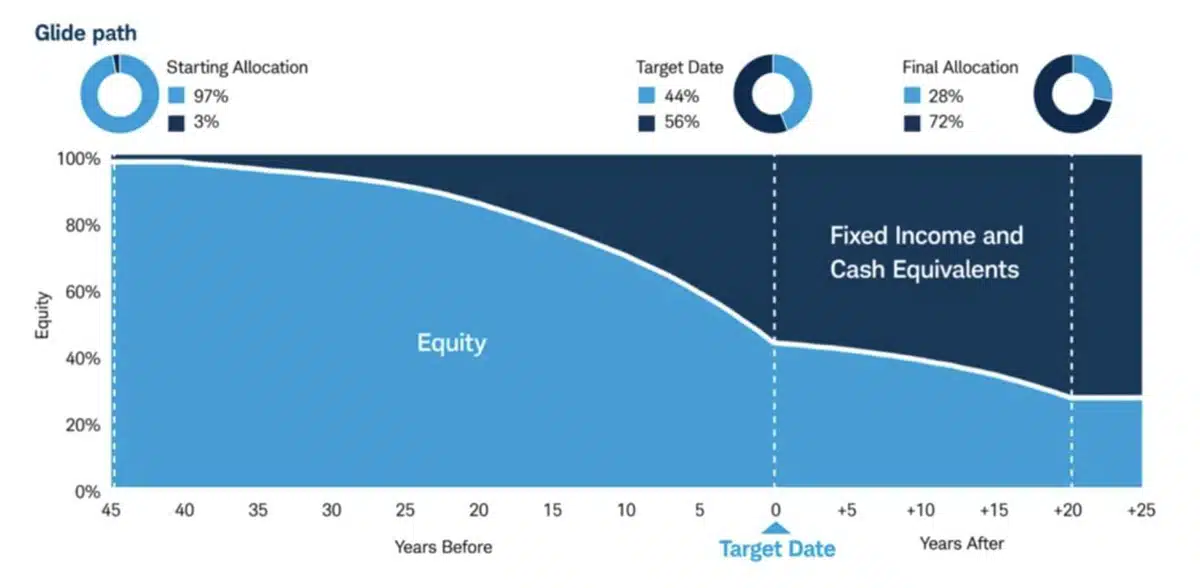

When the term Glide Path is used in a target date fund it refers to the planned, gradual shift in the fund’s asset allocation over time, designed to reduce investment risk as an investor approaches a specific target year—usually retirement. A typical glide path may look like the one below. Thus, when the investor is far from retirement the fund holds a higher percentage of stocks to pursue growth. This comes with higher portfolio volatility is higher, but time is on the investor’s side as they have decades before they need to make withdrawals. As the investor gets closer to retirement, the glide path systematically reduces stock exposure and increases bonds and cash, aiming to lower volatility and protect accumulated savings. And after the target retirement date depending on the fund’s philosophy, the glide path may continue to invest more conservatively.

So far this all sounds pretty reasonable. Let expert portfolio managers invest your portfolio and continually reduce the portfolio’s risk as you approach and enter retirement. Well, the situation is not so clear cut. A study at Research Affiliates found that a simple 50/50 portfolio of stocks and bonds outperformed a portfolio using a Glide Path by about 10%. Even more disturbing, another portfolio created by running the Glide Path portfolio in reverse, i.e. adding risk towards retirement, also outperformed the standard Glide Path portfolio, but this time by 22%! Add to this that Morningstar calculates that the average Target Date fund charges 0.62% vs. 0.10% for an index fund. Lastly, as sequence of return risk is highest at retirement, some research points toward reducing equity exposure as you approach retirement, then actually increasing it a few years later.

My purpose here is not to say that all target date funds are bad or ill-designed. My point is that your financial situation is multi-faceted and unique and target date funds may not be the best option for your portfolio. Rather than accept a cookie cutter solution, let us instead design an investment portfolio that is specific for your needs. Just like the unenhanced GPS signal, 10-12% margin for error in your retirement is unacceptably high when we can find ways to manage your portfolio with less risk.

Thoughtful planning creates confidence. Prepare your finances, career, and family goals for a stronger, more focused 2026.

Before you invest, protect your plan. Discover how Matt Williams uses protection-first planning to build stronger, more resilient financial strategies.

Discover how financial organization and comprehensive planning can protect your family, reduce stress, and create lasting peace of mind.

As the U.S. population continues to age, the demand for long-term healthcare is expected to rise steadily.