Investment Planning: Retirement Glide Path

Explore smarter retirement planning beyond target date funds with a customized glide path built for your goals and risk tolerance.

This month, I want to highlight some research from our primary ETF provider, Dimensional Fund Advisors, with a timely reminder that the stock market and the economy, although related, move very differently over time.

Chris Steward, CFP®, CFA®, RICP®, M.A. (CANTAB) | Director of Investments at Impact Advisors Group

Against the backdrop of heightened political uncertainty, potential trade wars and lower consumer sentiment, investors may have concerns about whether the US could tip into a recession. The National Bureau of Economic Research identifies recessions using backward-looking data, so we will not know we are in recession until after it has begun.

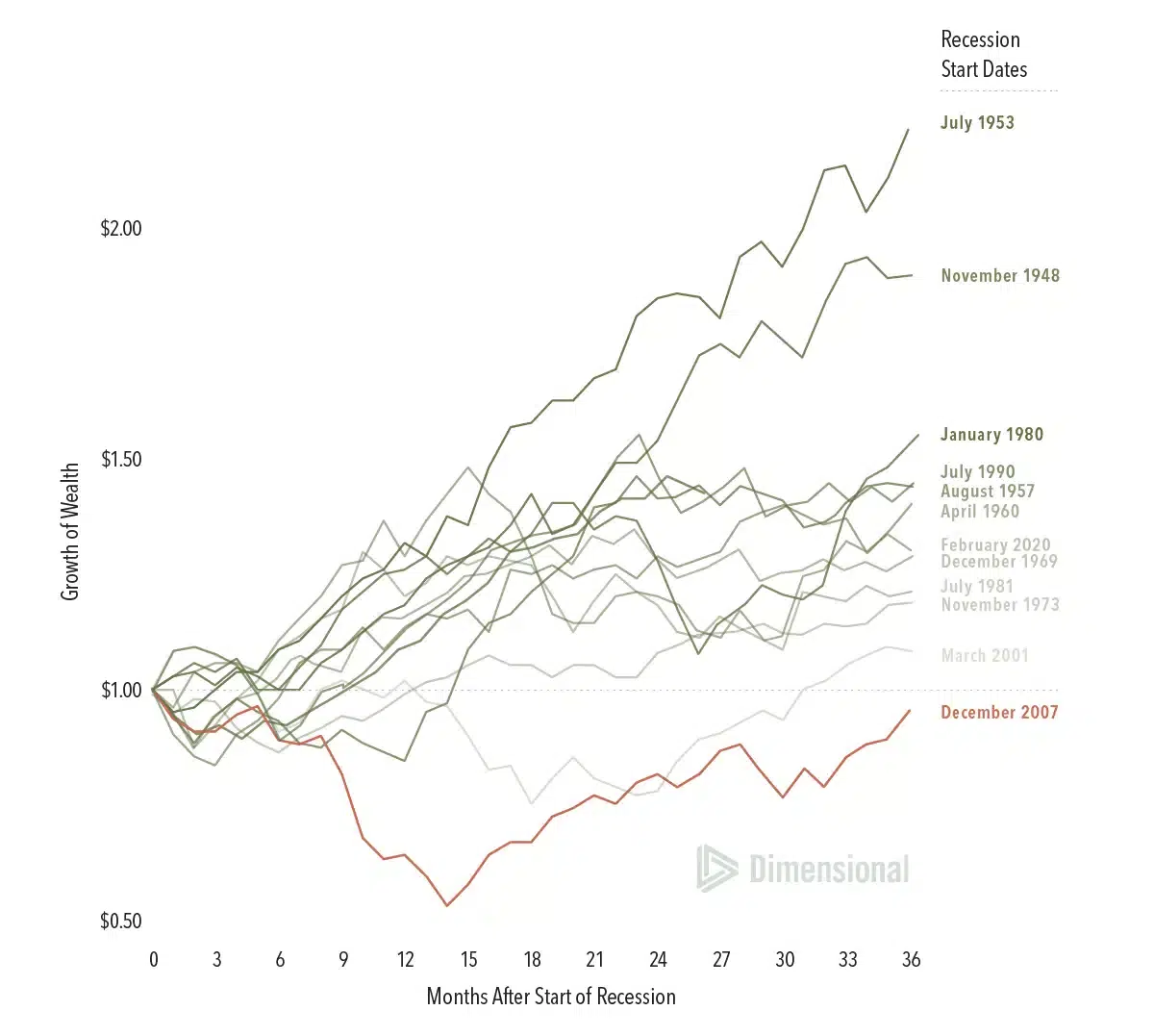

Luckily for investors, markets are forward-looking and generally react before we see slower economic growth show up in the macroeconomic data. This also means that expected stock returns are positive, even when the economic outlook is weak. This is borne out in the historical data. One dollar invested at the start of a recession saw positive returns after three years in 11 out of 12 past recessions. The average of the three-year returns after the start of a recession was 43.2%, which is nearly identical to the 41.8% average return of all three-year periods from 1947 to 2024. (1)

Exhibit 1: Growth of a Dollar for US Stocks over a 3-Year Period Beginning from the First Month of Recession

January 1947–March 2025

In USD. Each line shows the growth of $1 for a hypothetical investment in the Fama/French Total US Market Research Index over the 36 months starting the month after the relevant recession start date. Data presented is hypothetical and assumes reinvestment of income and no transaction costs or taxes. Sample includes 16 US recessions as identified by the National Bureau of Economic Research (NBER) from January 1947 to December 2024. NBER defines recessions as starting at the peak of a business cycle. A business cycle is a description of the various stages of economic output. The chart is for illustrative purposes only and is not indicative of any investment. The Fama/French indices represent academic concepts that may be used in portfolio construction and are not available for direct investment or for use as a benchmark. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment. See “Index Descriptions” for descriptions of Fama/French index data.

This post was written and first distributed by Dimensional Fund Advisors. Above the Fray is a weekly newsletter providing timely investment insights on current market events and trends. Join our mailing list to receive future editions in your email inbox. You can also browse earlier editions of Above the Fray.

INDEX DESCRIPTIONS

Fama/French Total US Market Research Index: July 1926–present: Fama/French Total US Market Research Factor + One-Month US Treasury Bills. Source: Ken French website.

Results shown during periods prior to each index’s inception date do not represent actual returns of the respective index. Other periods selected may have different results, including losses. Backtested index performance is hypothetical and is provided for informational purposes only to indicate historical performance had the index been calculated over the relevant time periods. Backtested performance results assume the reinvestment of dividends and capital gains. Profitability is measured as operating income before depreciation and amortization minus interest expense scaled by book. Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP.

FOOTNOTES

(1) Source: Fama/French Total US Market Research Index. The sample start date is based on quarterly US gross domestic product data, a key measure used to identify changes in economic activity across the business cycle that is first available starting in 1947.

DISCLOSURES

The information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed by Dimensional to be reliable, and Dimensional has reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, a recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Before acting on any information in this document, you should consider whether it is appropriate for your particular circumstances and, if appropriate, seek professional advice. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized reproduction or transmission of this material is strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

This material is not directed at any person in any jurisdiction where the availability of this material is prohibited or would subject Dimensional or its products or services to any registration, licensing, or other such legal requirements within the jurisdiction.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd., Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

RISKS

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

Explore smarter retirement planning beyond target date funds with a customized glide path built for your goals and risk tolerance.

Thoughtful planning creates confidence. Prepare your finances, career, and family goals for a stronger, more focused 2026.

Before you invest, protect your plan. Discover how Matt Williams uses protection-first planning to build stronger, more resilient financial strategies.

Discover how financial organization and comprehensive planning can protect your family, reduce stress, and create lasting peace of mind.