Investment Planning: Retirement Glide Path

Explore smarter retirement planning beyond target date funds with a customized glide path built for your goals and risk tolerance.

Author: Brandon Jordan, CFP®, CHFC®, CEPA®, CVGA®, CLU®, MSA, EA | CEO of Impact Advisors Group

Ten years ago, the Exit Planning Institute (EPI) embarked on a groundbreaking research endeavor in collaboration with several partners called the State of Owner Readiness Survey. This first-of-its-kind survey studied the personal preparedness of business owners for exiting their companies and assessed their companies’ readiness for such transitions. What came out of this survey was information that business owners were unaware misinformed about what exit planning is and thus ill-prepared for their inevitable exit.

A decade later, the newly released 2023 National State of Owner Readiness report reflects a transformed landscape, business owners nationwide are undoubtedly more educated and aware than ever before. They are also more prepared for their exit and focused on blending and aligning the most critical components of a successful and significant exit:

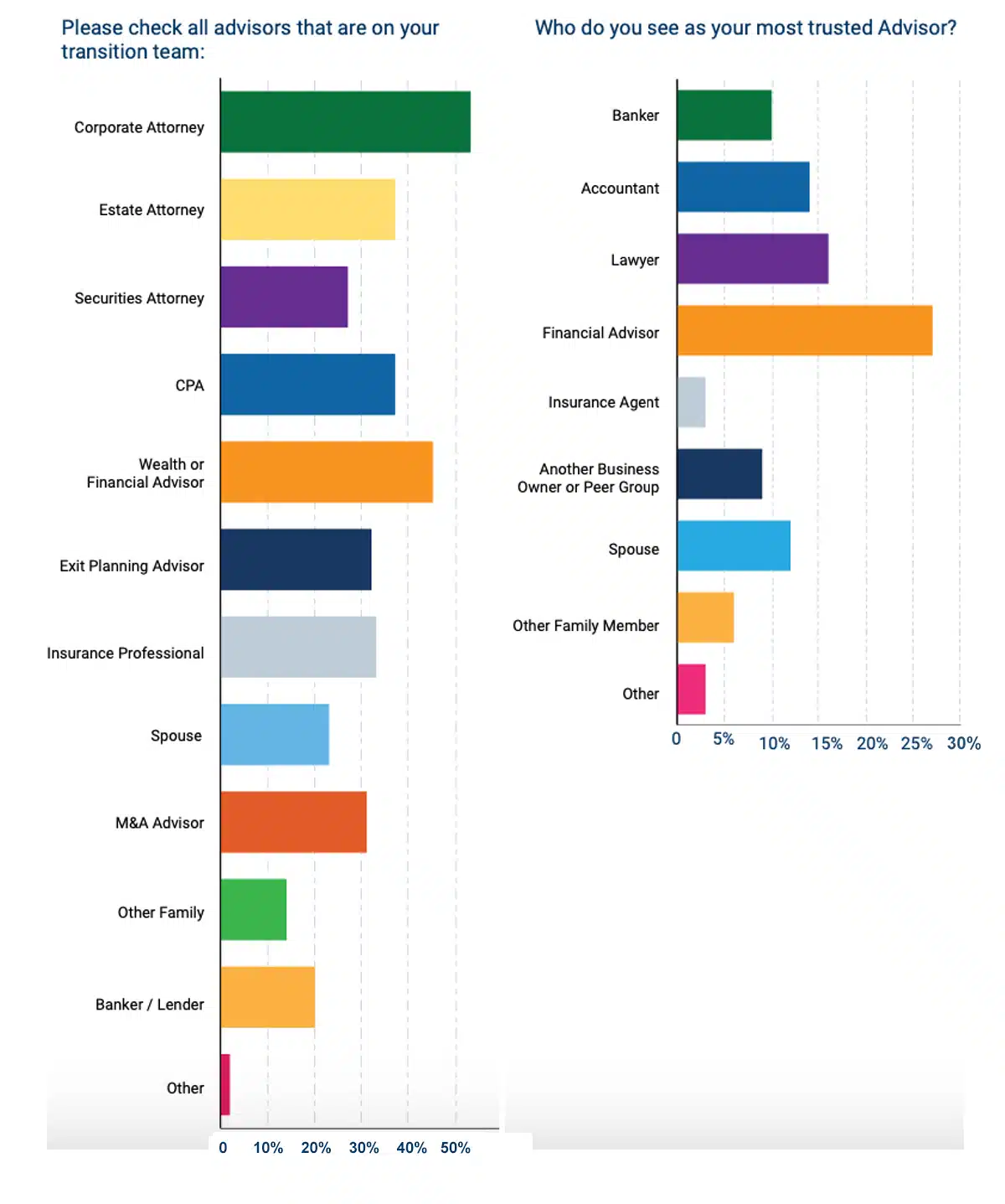

There are numerous intriguing conclusions from the 2023 report which surveyed more than 1,000 business owners. IAG has pulled out several data points that business owners may find to be of interest.

There is still work to be done! IAG, with its team of Certified Financial Planners (“CFP®”) and Certified Exit Planning Advisors (“CEPA®”), is uniquely equipped to help business owners close the gap between “what is” and “what’s possible” so that they can achieve their business, personal, AND financial goals.

To explore what’s possible:

Explore smarter retirement planning beyond target date funds with a customized glide path built for your goals and risk tolerance.

Thoughtful planning creates confidence. Prepare your finances, career, and family goals for a stronger, more focused 2026.

Before you invest, protect your plan. Discover how Matt Williams uses protection-first planning to build stronger, more resilient financial strategies.

Discover how financial organization and comprehensive planning can protect your family, reduce stress, and create lasting peace of mind.