Investment Planning: Retirement Glide Path

Explore smarter retirement planning beyond target date funds with a customized glide path built for your goals and risk tolerance.

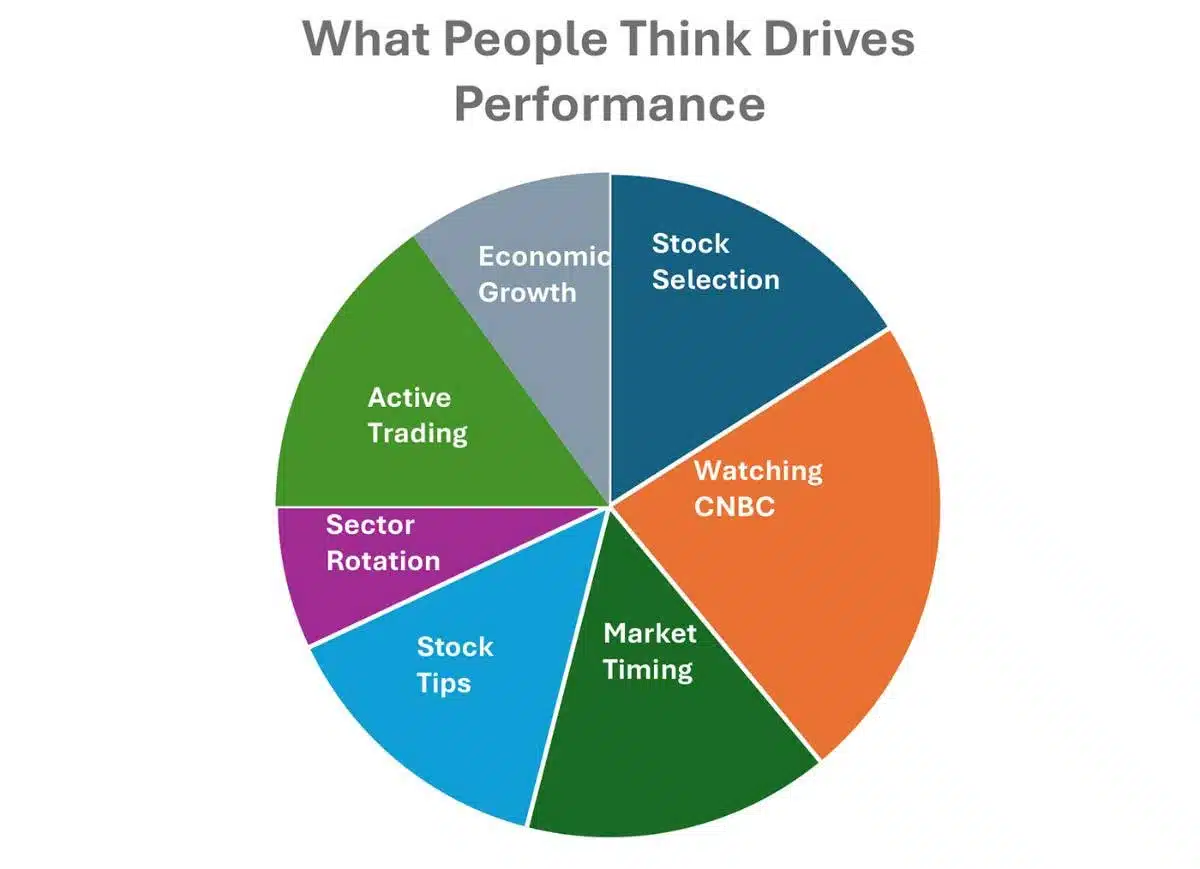

Most investors believe that the cornerstone of an investment portfolio is based upon researching individual stocks and actively trading them. Others believe that getting stock tips, timing the market, or using sector rotation is the key to success. Of course, much of the advertising for brokerage account such as eTrade, or Fidelity, reinforce these misperceptions as active trading is more likely to benefit the broker than the investor.

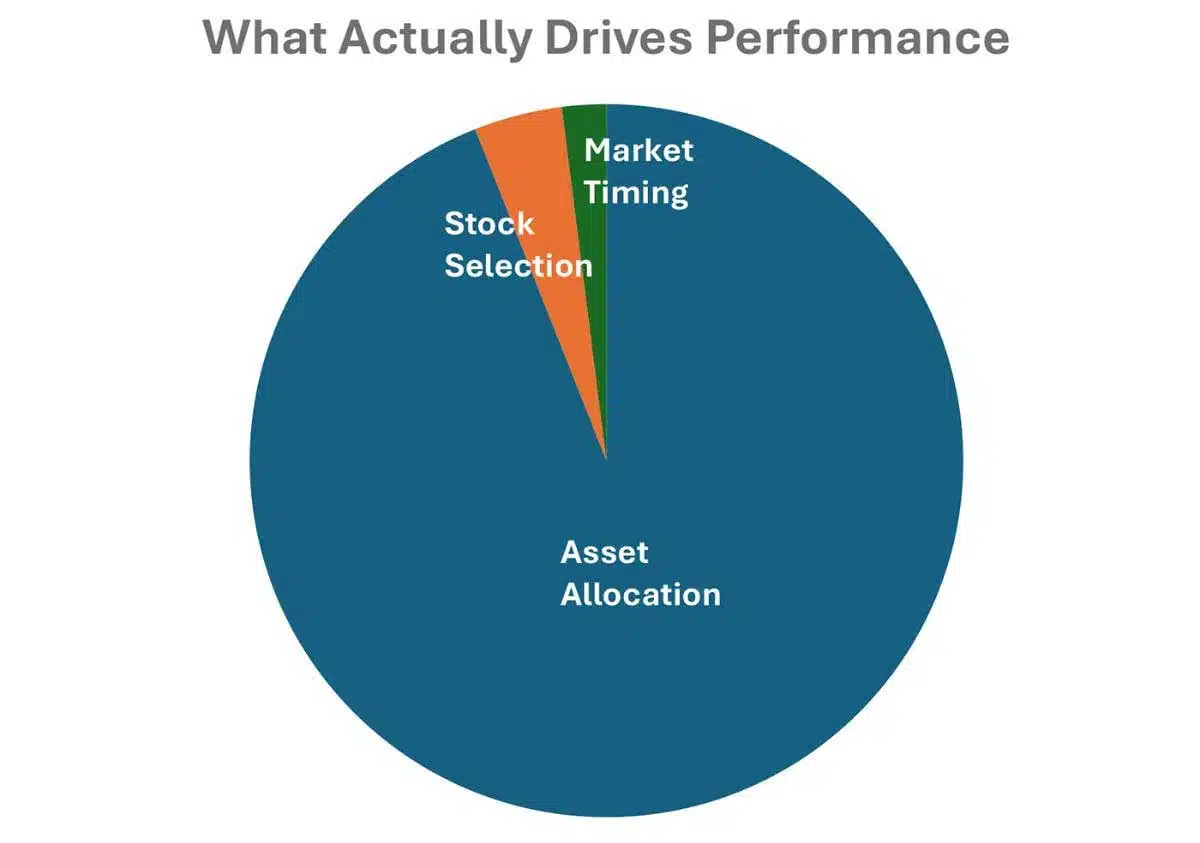

In reality, investing success is overwhelmingly due to creating the asset allocation that matches your risk tolerance, and trading as little as possible except for an annual rebalancing back to your target allocation. The seminal 1995 Brinson, Hood, and Beebower study showed that 93.6% of portfolio returns were explained by the asset allocation. On average, active management actually detracted from returns by about 1% per year.

Studies have shown that active traders underperform buy-and-hold investors by around 1.5 percentage points per year. When Vanguard examined a group of accounts that had superior performance, they found that those accounts had made no changes versus the majority of accounts that traded frequently.

As the economist Paul Samuelson said: “Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”

Explore smarter retirement planning beyond target date funds with a customized glide path built for your goals and risk tolerance.

Thoughtful planning creates confidence. Prepare your finances, career, and family goals for a stronger, more focused 2026.

Before you invest, protect your plan. Discover how Matt Williams uses protection-first planning to build stronger, more resilient financial strategies.

Discover how financial organization and comprehensive planning can protect your family, reduce stress, and create lasting peace of mind.