Investment Planning: Retirement Glide Path

Explore smarter retirement planning beyond target date funds with a customized glide path built for your goals and risk tolerance.

Author: Chris Steward, CFP®, CFA®, RICP®, M.A. (CANTAB) | Director of Investments at Impact Advisors Group

The stock market has been incredibly resilient so far this year gaining 9.5% year to date. If that rate of return continues, the full year return could well be about 16%. I don’t make any short-term predictions about where the market is going, but it is worth remembering that there was a very sharp correction along the way in April.

As Dimensional Fund Advisors (DFA) pointed out at the time:

“Stocks turned up the volatility to 11 in April. The decline of –10.5% over April 3–4 was the worst two-day stretch for the S&P 500 Index since March 12, 2020. Then, on April 9, the index gained 9.5%, the third-largest one-day return since 1987. … Trailing one-, three-, and five-year returns were in line with historical ranges, with or without the rally on April 9. And the effect of a single day’s return becomes muted when expanding the measurement period. For example, while the one-year return swung from –2.9% to 6.2% after April 9, the five-year return budged much less, from 14.0% to 16.4%.”

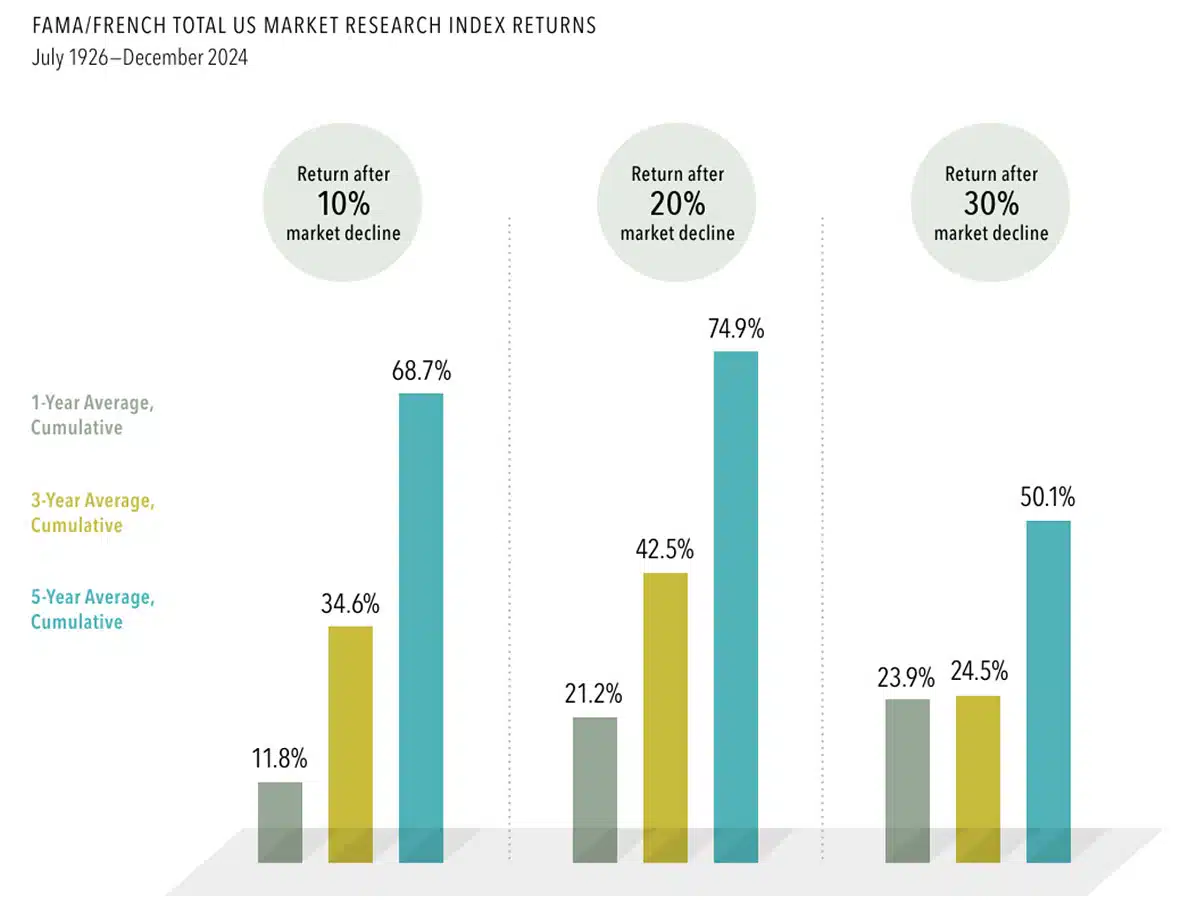

This volatility tested the resolve of all investors, even those who have accepted the argument that although stock market returns are volatile, that they tend to be positive in the long run. It is also worth pointing out that although this year’s correction was short-lived, as was the Covid downturn in 2020, most market corrections last months or years, with the average bear market lasting 9.6 months. However, as the graphic from DFA illustrates, staying the course and remaining in the market usually pays off.

Explore smarter retirement planning beyond target date funds with a customized glide path built for your goals and risk tolerance.

Thoughtful planning creates confidence. Prepare your finances, career, and family goals for a stronger, more focused 2026.

Before you invest, protect your plan. Discover how Matt Williams uses protection-first planning to build stronger, more resilient financial strategies.

Discover how financial organization and comprehensive planning can protect your family, reduce stress, and create lasting peace of mind.