Investment Planning: Retirement Glide Path

Explore smarter retirement planning beyond target date funds with a customized glide path built for your goals and risk tolerance.

Author: Chris Steward, CFP®, CFA®, RICP®, M.A. (CANTAB) | Director of Investments at Impact Advisors Group

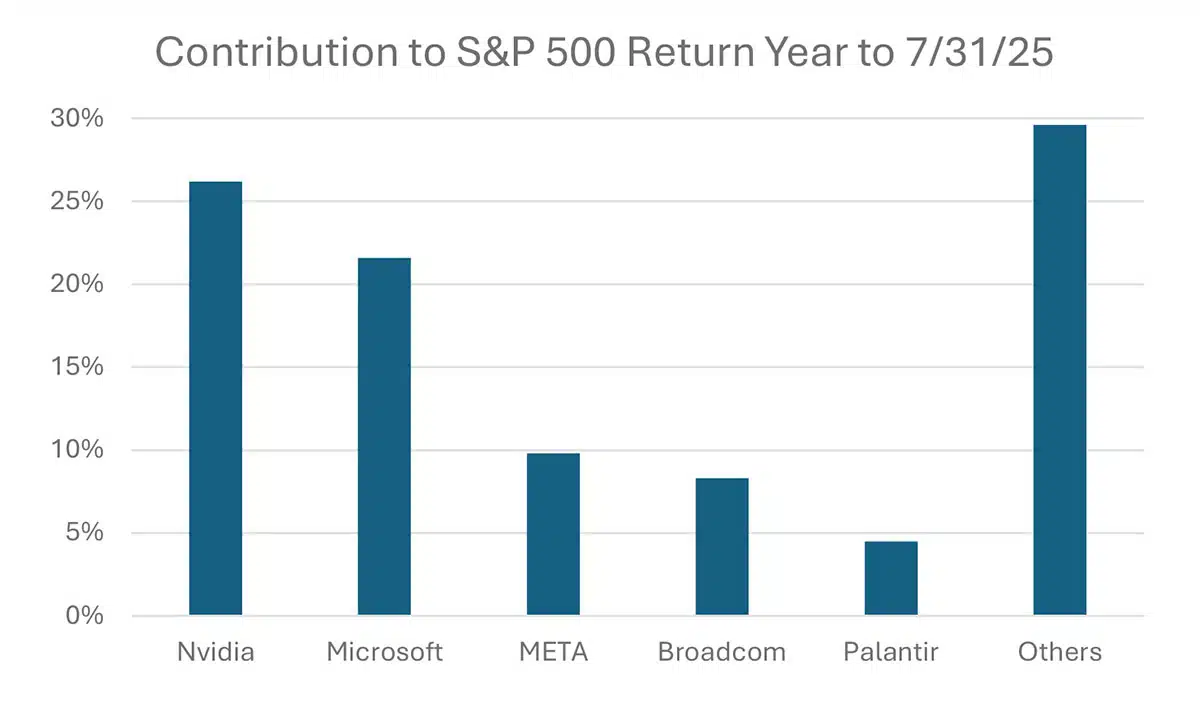

The stock market this year has posted remarkable performance against a backdrop of discouraging macroeconomic developments. It is worth pointing out, however, that the strong market performance has come from only a handful of stocks. In fact, in the year through July 31, only 5 stocks have contributed more than 70% of the returns of the S&P 500. Nvidia itself has grown to be nearly 18% of the S&P 500.

Although the year to date returns have been incredibly concentrated, so have the earnings in the market. As my erstwhile colleague at Fidelity Jurrien Timmer posted in his weekly commentary: “The juggernaut that is the Mag 7 continued to power the bull market train forward this week, with the M7 index finally besting its all-time high from February. The earnings story has been powerful and has carried most of the load. The payout (dividends plus buybacks) for the M7 has grown from $254 in 2023 to $437 in 2025. The AI boom is real, and it’s showing up in the data.”

Or as David Wagner III, of our investment partner Aptus Funds, points out “the Mag 7 was driving most/all of the earnings growth in 2023/2024, while the rest of the index was in a modest earnings recession.” Many in the market have been waiting for a bit of a normalization with the earnings (and performance) of the remaining S&P 493 catch up a bit to the Magnificent 7 stocks. However, they are still waiting.

Part of Nvidia’s growth, as well as other Tech companies, is the “gold rush fever” in trying to capture a competitive advantage in the AI Marketplace. If you have read my commentary before, you know that I do not try to time the market, nor do I recommend it for anyone else. “Time in the market beats timing the market” as the saying goes. Or as John Maynard Keynes put it: “The market can remain irrational longer than you can remain solvent.” I do remember examples of extreme valuation from the past. For example, at the height of the Japanese stock bubble, the grounds of the Imperial Palace in Tokyo were worth more than all of the real estate in California. And during the TMT (Technology, Media, and Telecom) bubble Yahoo alone had a market cap of $125 billion in 2000, but was sold for only $4.8 billion in 2016.

Explore smarter retirement planning beyond target date funds with a customized glide path built for your goals and risk tolerance.

Thoughtful planning creates confidence. Prepare your finances, career, and family goals for a stronger, more focused 2026.

Before you invest, protect your plan. Discover how Matt Williams uses protection-first planning to build stronger, more resilient financial strategies.

Discover how financial organization and comprehensive planning can protect your family, reduce stress, and create lasting peace of mind.