Investment Planning: Retirement Glide Path

Explore smarter retirement planning beyond target date funds with a customized glide path built for your goals and risk tolerance.

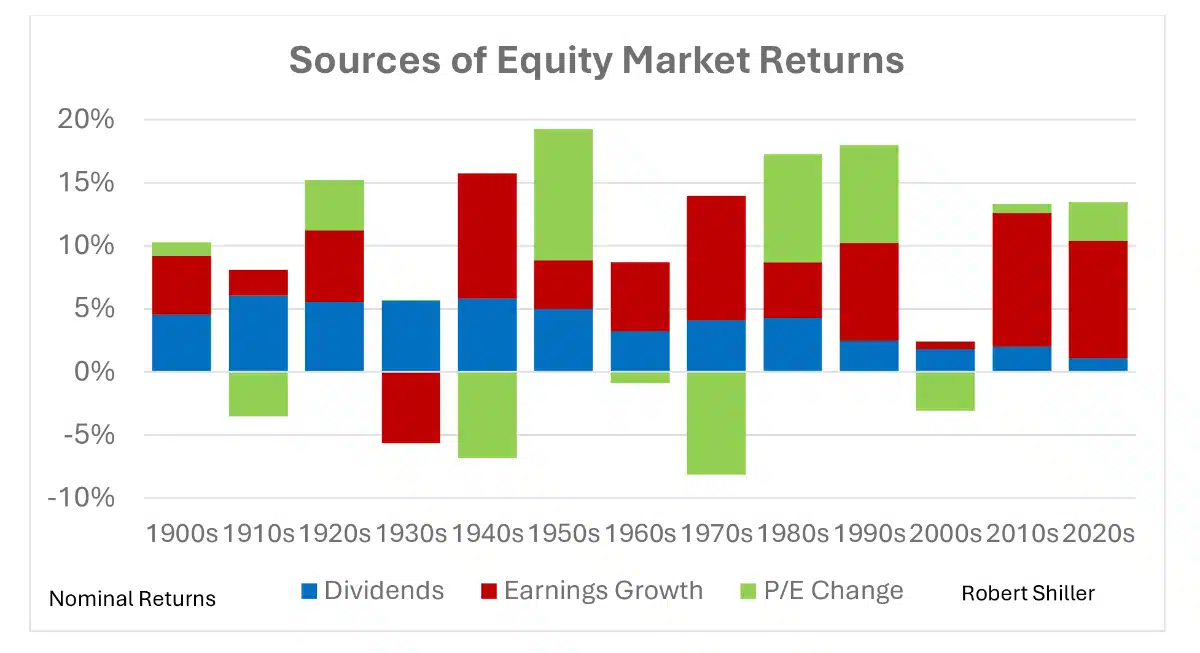

What has driven equity market performance in the past? About 40-50% of returns have come from Dividends historically, although in recent decades that proportion has shrunk substantially. Earnings Growth has been a consistent driver of returns, and especially large over the last 15 years. Then, there is P/E Change, a measure of how bullish investors are because it is driven by how much investors are willing to pay for stocks today based upon their assessment of their future performance. P/E Change since 1900 has contributed only about 1% to equity market returns, but over the past five decades, it has contributed about 3.4% or 28% of the return of the S&P 500.

Over time the reinvestment of dividends can make a significant difference in total returns. Over the past 20 years, the market has grown 4.4 times in price terms; with reinvested dividends it has grown 6.5 times. Over 30 years in price terms the market rose 9.8 times, vs. 17.2 times with all dividends reinvested.

Of course, these strong returns require the reinvestment of dividends back into the market. Some investors favor dividend paying stocks because of the income that they generate, but remember that there is no free lunch: the stock price declines by the amount of the dividend to be paid when the stock begins to trade “ex-dividend”. Also be careful not to confuse this analysis of the importance of dividends to market returns with expected returns of high dividend paying stocks vs. those that pay low dividends, or no dividends.

Explore smarter retirement planning beyond target date funds with a customized glide path built for your goals and risk tolerance.

Thoughtful planning creates confidence. Prepare your finances, career, and family goals for a stronger, more focused 2026.

Before you invest, protect your plan. Discover how Matt Williams uses protection-first planning to build stronger, more resilient financial strategies.

Discover how financial organization and comprehensive planning can protect your family, reduce stress, and create lasting peace of mind.