Investment Planning: Retirement Glide Path

Explore smarter retirement planning beyond target date funds with a customized glide path built for your goals and risk tolerance.

Author: Chris Steward, CFP®, CFA®, RICP®, M.A. (CANTAB) | Director of Investments at Impact Advisors Group

Most anyone who has read my posts before probably knows that I am a pilot, but may not know that I grew up in Michigan. Although Massachusetts is famous for its summer destinations like Cape Cod and Martha’s Vineyard, for me it’s not summer without a visit to our family cottage located about 30 minutes south of the Mackinac bridge.

Last summer on our way to Northern Michigan, my wife and I (and our Golden Retriever) stopped off in Canandaigua, south of Rochester, to see James Taylor in concert. The next day, we were going to finish our trip, flying over Ontario on our way to a fuel stop in Southeastern Michigan. I generally pride myself on being a careful pilot and doing a thorough weather briefing, and comprehensive preflight of the airplane.

The trick to a weather briefing is that you need multiple sources to get the full picture. Much like the Heisenberg Uncertainty Principle, the more you focus on one aspect, such as the forecast weather at one specific airport, means that you may overlook the big picture, such as the location and movements of cold fronts. In this instance, I focused nearly exclusively on the airport forecasts along our route, most of which predicted a short window of low ceilings and storms lasting only an hour or two. When we finally got in the air, the big picture became clear, and it was not an attractive one.

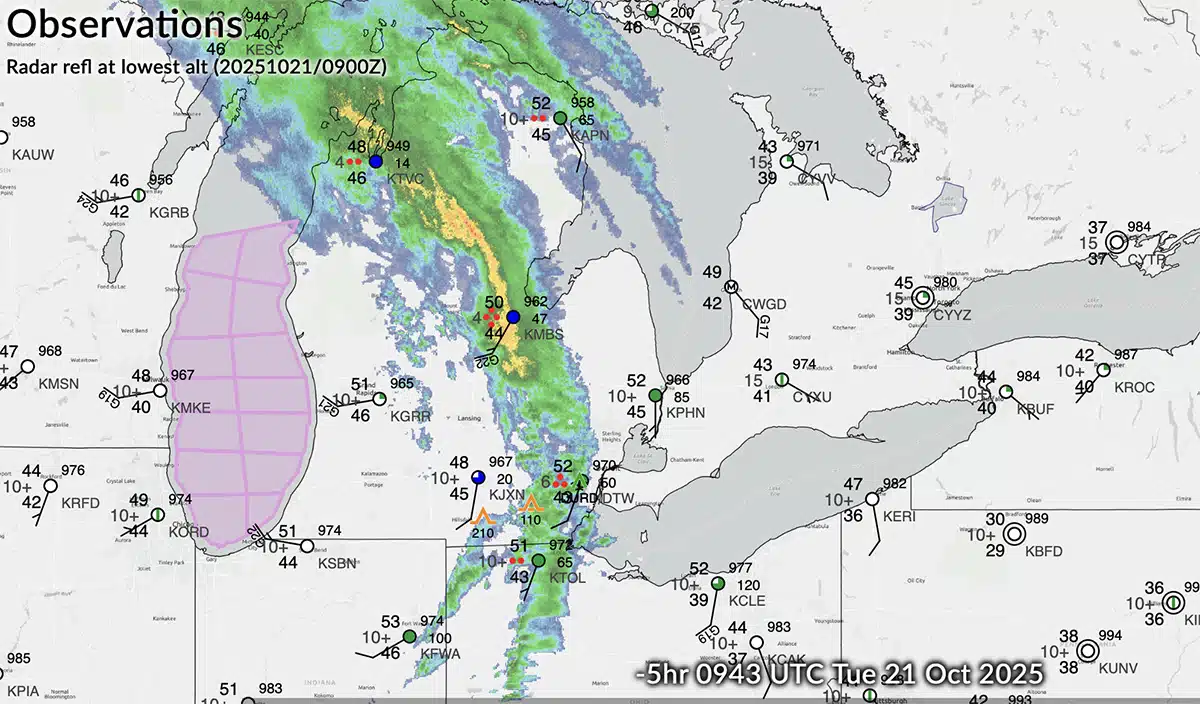

Like the picture below, there was a long line of weather from Lake Superior well into Ohio. The picture I saw had more Red (severe weather) than this snapshot. As the line of weather was not particularly wide and was moving relatively fast, normally we could have flown West for an hour or so, then landed to refuel and wait for the weather to pass. However, we were caught between a rock and a hard place. We had roughly a 90-minute flight over Canada to reach our refueling stop and the bad weather was already above our destination and moving East. Canadian authorities are OK with US planes transiting their airspace, however, landing there without the proper prior approvals would be a big deal absent a true emergency, not one due to improper planning. Thus, we spent another night at our hotel and flew out the next day.

So, what does this have to do with Financial Planning? Just as in aviation, taking a quick look at the weather radar, or even just the weather outside your window, is not enough to ensure a safe and comfortable cross-country trip. In Financial Planning we are generally planning for a 30-year or longer time horizon, thus we need to make forecasts and stress-test our assumptions. Whether it is testing our ability to handle a market downturn, deal with unexpected health issues, or ensure that our estate plan is robust and up to date, it is important to dig into the details rather than assume that everything will work out all right.

The cost of my incomplete weather planning was limited to another night in a hotel and less time with family. The stakes in retirement can be far more costly.

Explore smarter retirement planning beyond target date funds with a customized glide path built for your goals and risk tolerance.

Thoughtful planning creates confidence. Prepare your finances, career, and family goals for a stronger, more focused 2026.

Before you invest, protect your plan. Discover how Matt Williams uses protection-first planning to build stronger, more resilient financial strategies.

Discover how financial organization and comprehensive planning can protect your family, reduce stress, and create lasting peace of mind.