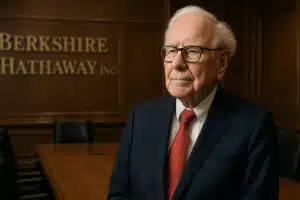

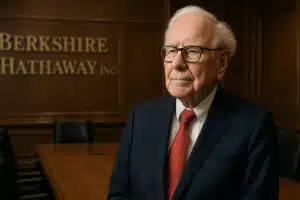

Financial Planning: Lessons from Warren Buffet

Warren Buffett recently announced he will be stepping down as CEO of Berkshire Hathaway at the end of the year.

We have commented before on the mechanics of accumulating and preserving your wealth by building a low-cost, globally diversified investment portfolio aimed at your personal goals and risk tolerances. Today, let’s consider your money management from a different angle: What are your personal goals, and why do they matter?

For starters, your goals are the lead for your financial plans. Or at least they should be. You can have the sturdiest plans around, but if they are hitched to the wrong horse, they are unlikely to take you where you want to go.

To illustrate, consider this 2023 anecdote about how a different system, a school bus scheduling system, ran aground due to misguided goals.

At a glance, the city’s plans seemed solid enough. It sought to streamline the number of routes needed to transport its thousands of students across some 150 schools. By this measure, their AI-driven project was a “success,” reducing 730 routes to a planned 600.

Unfortunately, these plans proved disastrous when it was discovered that fewer routes were the wrong goal for delivering overall improvement. On opening day, there were reports that “a ton of kids” did not make it to school at all. Among those who did, “some students did not get home until almost 10:00 PM.” The school system was forced to cancel classes for the remainder of the week to work on getting back on track.

At least when bus schedules run amok, the problem is immediately obvious. Unfortunately, that is not always the case with your financial goals. Sometimes, errant choices made years ago or as a series over time are only obvious in hindsight.

Which is why we recommend you:

It is also essential to define your financial goals as more than just desired dollars.

What do you want to spend your money on? How much will it cost? When will the money need to be available?

These questions factor into how much you will want to set aside for each goal; how much you can spend in other ways; and importantly, how to manage your investments over time.

By targeting well-crafted financial goals, we can better aim your overall investment strategies and selections. For example, money you will not need to spend for some time can be invested in assets that are expected to deliver higher long-term returns, but that also exhibit a wilder ride along the way. Money you are depending on to fund near-term goals should be protected against the market’s short-term changeability. Investments that will probably deliver lower returns, but more dependable outcomes are the tickets here.

Admittedly, it can be tough to plan your financial future in a world filled with obstacles and opportunities. But the terrain only worsens in the absence of well-crafted goals. If you do not know how much money you will need, when, and why, you end up chasing after the latest fads (buying high) or fleeing market risks (selling low). Beyond the financial damage done, the emotional toll can be terribly taxing as well.

Without personal financial goals to lead the way, investing becomes a pointless practice. Not sure where to start? Reach out to us to learn more.

FREE FINANCIAL ASSESSMENT

With all the uncertainty and volatility in today’s economy, the time is now to take a thorough look at your finances. To accurately plan for your financial future, you must first know where you currently stand. For these reasons, our Success Team at Impact Advisors Group is offering a free financial assessment for both individuals and business owners. Request yours today!

This post was written and first distributed by Wendy J. Cook.

Warren Buffett recently announced he will be stepping down as CEO of Berkshire Hathaway at the end of the year.

Smart investing starts with a plan. Learn why asset allocation, not stock picking, drives long-term portfolio performance.

80% of a company’s results are often created by 20% of their team, but what happens when those key employees leave?

IAG is proud to announce that Matthew Williams has been awarded the Accredited Estate Planner® (AEP®) designation.