The Hidden Risk Most Business Owners Carry: “The Bottleneck”

The Bottleneck is the hidden liquidity risk many business owners carry. Learn how to build flexibility beyond your business.

Author: Jon Bock, CPA/PFS, CEPA®, Candidate for CFP® Certification | Financial Advisor at Impact Advisors Group

Could you use this strategy to reduce your taxes?

As always in personal finance “It depends.” Cost Segregation studies have garnered significant attention in recent years for good reason. However, it’s crucial to have a deeper understanding of their benefits besides the initial rush of tax savings. We will dive into the details of cost segregation, its benefits, and how it may be an option for you.

What is a Cost Segregation Study?

A cost segregation study is a comprehensive analysis conducted by a cost segregation firm who use engineers to examine a property and segregate the individual components of real property to determine classification. The goal of this study is to identify and reclassify the various components of a property to take advantage of shorter depreciation periods.

Unlike Modified Accelerated Cost Recovery System (MACRS), where a building is depreciated over 27.5 years for residential properties or 39 years for commercial properties, a cost segregation study allows certain components to be depreciated at an accelerated pace.

The theory sounds great, but how does this work in practice?

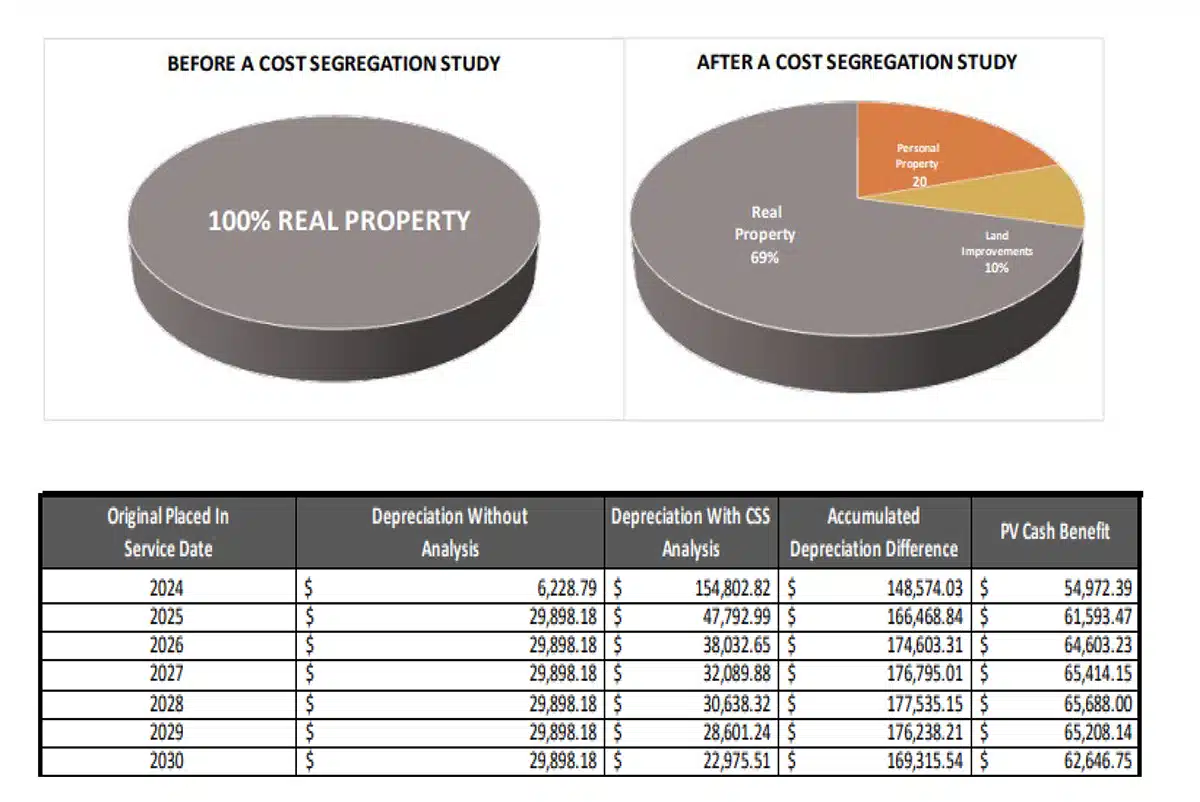

The below pie chart shows the before and after using an example real property.

This example highlights the allure of accelerated depreciation. The subject property was placed into service in late 2024 so under mid-month convention MACRS the first year only provides $6,228 of depreciation. But with a Cost Seg analysis performed the first-year depreciation could be accelerated to $154,802. This includes bonus depreciation too formally known as the special depreciation allowance. So, in this example, at a 37% federal tax rate the taxpayer would derive a benefit of $54,972 from the tax reduction based on this acceleration of depreciation.

1) IRS Audit

What certifications or credentials does a cost segregation “professional” need?

Believe it or not, the answer is NOTHING! Given that it’s your signature on the tax return and thus your liability, it is crucial you research any firm you may use for your study. The American Society of Cost Segregation Professionals offers a directory of Certified professionals with exam and experience requirements. Choosing the right firm helps to improve the odds of ensuring that the benefit exceeds the cost (cost of payment to the vendor AND cost of liability).

Red Flag Alert – You cannot DEPRECIATE LAND – recently we analyzed a cost segregation study where the firm severely underestimated the value of the land so they could promote excess tax savings. Don’t be deceived by this type of inflated marketing!

The government knows what your incentive is; this strategy needs to be implemented properly. Shortcuts now could make those tax savings vanish with penalties and fees later.

2) IMPACT on your overall wealth accumulation plan.

A crucial distinction to highlight is the amount of total depreciation does not change whether you use straight line or accelerate your depreciation schedule. This strategy shines as a timing mechanism to shift your depreciation to be advantageous to you. It is a time value of money puzzle that can be optimized for your benefit.

3) Understanding your tax rate now and in the future.

Do you know what your tax rate is? …. Probably not. We do! We review every client’s tax return. If you do not know what your tax rate is, it’s not feasible to determine if this strategy is worthwhile.

I’ll refer to this as the depreciation trap. Let’s say you are in the 22% or 24% marginal tax bracket, is front loading depreciation going to benefit you? Maybe, but not as likely as those in the 32%, 35% and 37% brackets.

Your unrecaptured gain is taxed as ordinary income up to 25%. This provision surprises many taxpayers.

So as an example, if you are in the 37% bracket and do a cost segregation, you are shielding income taxed at 37% and if you sold the property in the next year your unrecaptured gain would be capped at 25%. It is tax arbitrage with a 12% differential. Let’s say you accelerated $300,000 this year and then you sold the property the next year. Your spread would be $36,000 depending on your tax rates the following year.

What if you are in a lower tax bracket with lots of allowable depreciation and then you sell in a year when gains are plentiful does the government care? No, they don’t, your unrecaptured gain is based on the year of disposition. Wait, so I could shield income at 12% and 22% and pay up to 25% on the sale? Indeed, and that is the depreciation trap.

4) Understanding depreciation recapture provisions.

We cannot delve into the mechanics in this newsletter, but a cursory understanding of recapture is vital. When you take a depreciation deduction against your ordinary income, eventually this will become an unrecaptured gain in the future. Your basis is reduced by the allowable depreciation. It is known as a recharacterization of gain when you sell the real property. This gain is not taxed at favorable capital gains tax rates. This gain is taxed as ordinary income up to 25%. Section 1245 and 1250 are complex and every scenario has nuance especially with a cost segregation as you are changing the character of 1250 property to accelerate your depreciation.

The Solution(s):

Find the right broad-based and experienced thinking partner/personal CFO to help you navigate decisions that are IMPACTful to you and your family.

Your Success Team advisors need to collaborate when you implement this strategy. The focus should be on the long game; not just the current tax year. Don’t let the tax tail wag the dog.

You could have substantial savings from using cost segregation, but it takes an evidence-based approach as well as a well-aligned Success Team to make sure it’s done right for you.

The Bottleneck is the hidden liquidity risk many business owners carry. Learn how to build flexibility beyond your business.

Explore smarter retirement planning beyond target date funds with a customized glide path built for your goals and risk tolerance.

Thoughtful planning creates confidence. Prepare your finances, career, and family goals for a stronger, more focused 2026.

Before you invest, protect your plan. Discover how Matt Williams uses protection-first planning to build stronger, more resilient financial strategies.