Financial Planning: Cautious Optimism Leads to New Heights

Market volatility is inevitable, but history shows patience and a long-term strategy often reward investors.

Market volatility is inevitable, but history shows patience and a long-term strategy often reward investors.

The stock market has been incredibly resilient so far this year, gaining 9.5% year to date.

Learn how to protect your business from internal threats like the 5 D’s (death, disability, divorce, distress and disagreement).

Avoid costly tax mistakes. Learn how proactive planning can help you keep more of your money and stop overpaying the IRS.

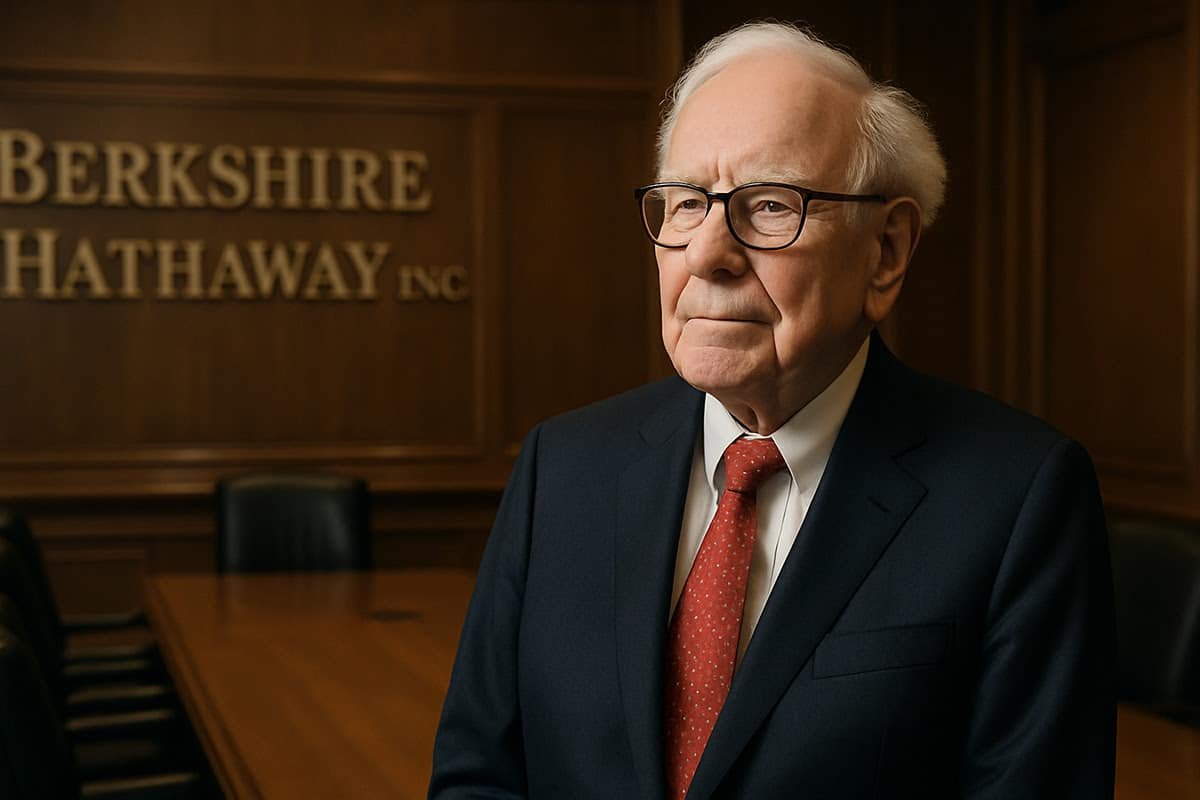

Warren Buffett recently announced he will be stepping down as CEO of Berkshire Hathaway at the end of the year.

Smart investing starts with a plan. Learn why asset allocation, not stock picking, drives long-term portfolio performance.

80% of a company’s results are often created by 20% of their team, but what happens when those key employees leave?

IAG is proud to announce that Matthew Williams has been awarded the Accredited Estate Planner® (AEP®) designation.

Many find fulfillment in their work and plan to continue their careers well into their 70s and even beyond.

Against the backdrop of heightened political uncertainty and lower consumer sentiment, investors may have concerns about a recession.

To improve the odds that our business wins long term, it’s essential that we build up our defense against threats, both internal and external.

The International Trade Administration defines a tariff as “a tariff or duty is a tax levied by governments on the value including freight.”

When we experience bouts of market volatility, it can be disconcerting to watch our account balance decline in value.

In times of uncertainty and/or adversity, refocusing on the fundamentals is a time-tested solution.

When markets feel as shaky as they do now in the United States, it is normal to ask: Is this time different?