Investment Planning: Retirement Glide Path

Explore smarter retirement planning beyond target date funds with a customized glide path built for your goals and risk tolerance.

Author: Chris Steward, CFP®, CFA®, RICP®, M.A. (CANTAB) | Director of Investments at Impact Advisors Group

Alternative Investments have continued to grow in recent years. Liquid Alternatives ETF assets have grown more than 5x since 2015 from less than $50 billion to close to $250 billion today. Alternative Investments cover a very broad range from Managed Futures, Option Overlay strategies and trading in Carbon Credits. In fact, anything other than a traditional Stock, Bond, or commingled fund can be considered an Alternative Investment.

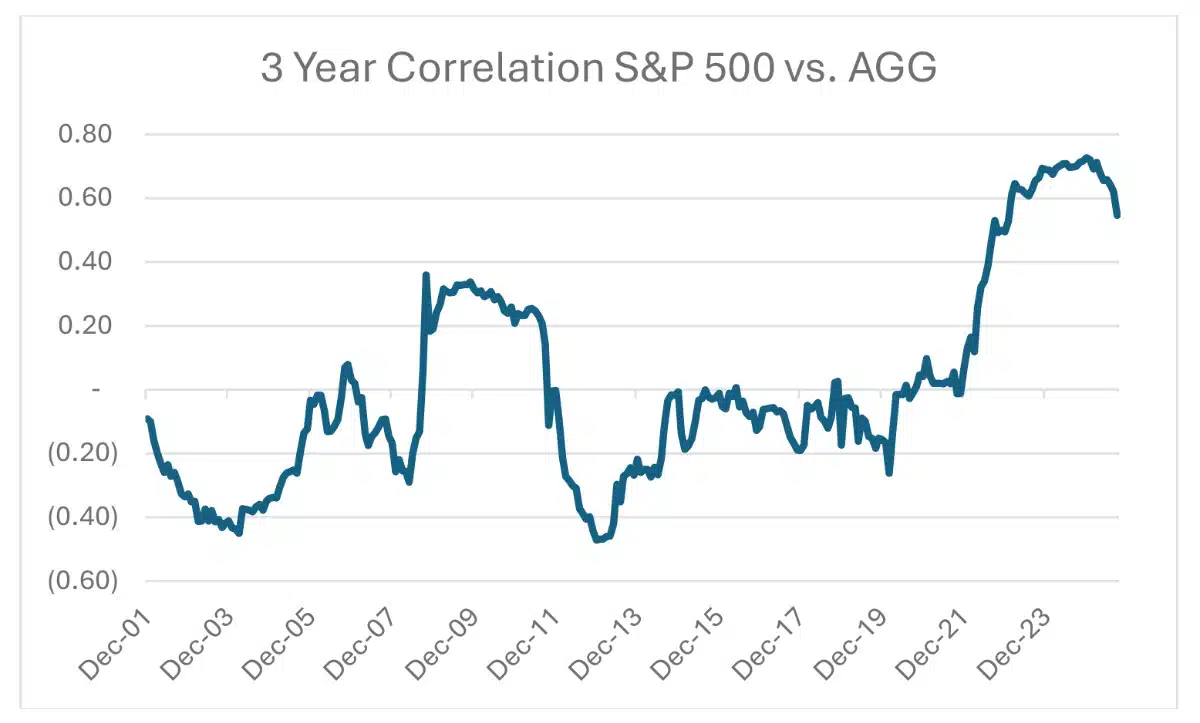

One of the primary attractions of Alternative Investments is their low correlation to Stocks and Bonds. Bonds have historically been the “anchor to windward” in diversified portfolios, providing some diversification and mitigating portfolio losses in a market downturn. However, in 2022, the Lehman Aggregate Bond Index was down by -13.0% when the MSCI All-Country World Index declined by -18.4%, and the S&P 500 was down by -18.1%. The diversification benefit that bonds have offered in the past has diminished significantly. As shown in the accompanying chart, 3 Year correlations between US Stock and Bonds historically ranged around a zero average while ranging from -0.4 to +0.4. For the past several years, the correlation has been above +0.6.

In the not-too-distant past most Alternatives were illiquid, with some requiring lengthy “lock-up” periods. However, in recent years the use of Alternatives strategies, once the exclusive domain of hedge funds and endowments, has become available to a wider audience of investors through the proliferation of Alternatives ETFs.

Impact Advisors Group, LLC is excited to share that it is partnering with KraneShares in adapting their Strategic Wealth Models, which include a strategic allocation to Alternatives, to IAG’s evidenced-based investment approach. These ETF portfolios will leverage KraneShares’ forward-thinking perspective and BlackRock® risk management tools and investment insights.

This partnership will provide Enhanced Strategic Allocations aimed at boosting risk-adjusted returns, plus cutting edge Risk Management from BlackRock’s® industry-leading Aladdin risk management technology platform, and Disciplined Portfolio Rebalancing.

Our partner, KraneShares is a specialist investment manager focused on China, Climate, and Alternative assets. The firm was founded in 2013, seeks to provide innovative, high conviction, and first to market strategies. They manage $11 billion and more than 30 ETFs. In 2017, KraneShares formed a strategic partnership with China International Capital Corporation (CICC) when they acquired a majority ownership stake.

Explore smarter retirement planning beyond target date funds with a customized glide path built for your goals and risk tolerance.

Thoughtful planning creates confidence. Prepare your finances, career, and family goals for a stronger, more focused 2026.

Before you invest, protect your plan. Discover how Matt Williams uses protection-first planning to build stronger, more resilient financial strategies.

Discover how financial organization and comprehensive planning can protect your family, reduce stress, and create lasting peace of mind.