Investment Planning: Retirement Glide Path

Explore smarter retirement planning beyond target date funds with a customized glide path built for your goals and risk tolerance.

Author: Chris Steward, CFP®, CFA®, RICP®, M.A. (CANTAB) | Director of Investments at Impact Advisors Group

The tongue in cheek joke that Garrison Keillor added at every close of his “Prairie Home Companion” radio show was that “all the children are above average.” It is funny because it is impossible: all of the children (choose whichever metric you like: height, grades, athletic ability, etc.) make up the average. Some will be higher or lower than the average, but it is by definition impossible for them to all be above average.

In investing, we have the “Dow Jones Average,” but in reality, all market indexes report the average returns of their constituent stocks or bonds. Still, in any period, some stocks, bonds, or fund managers may have returns significantly higher than the index. In general, it is very difficult to repeat such outperformance with any regularity. There have been very famous investors over time, like Peter Lynch who managed Fidelity’s Magellan Fund, George Soros, or Warren Buffet. However, as fund manager Dimensional Fund Advisors has pointed out, picking the best performing managers generally results in poor performance. DFA’s research shows that of the funds with top quartile 5-year performance in one period, less than one quarter of them remained in the top quartile over the next five-year period.

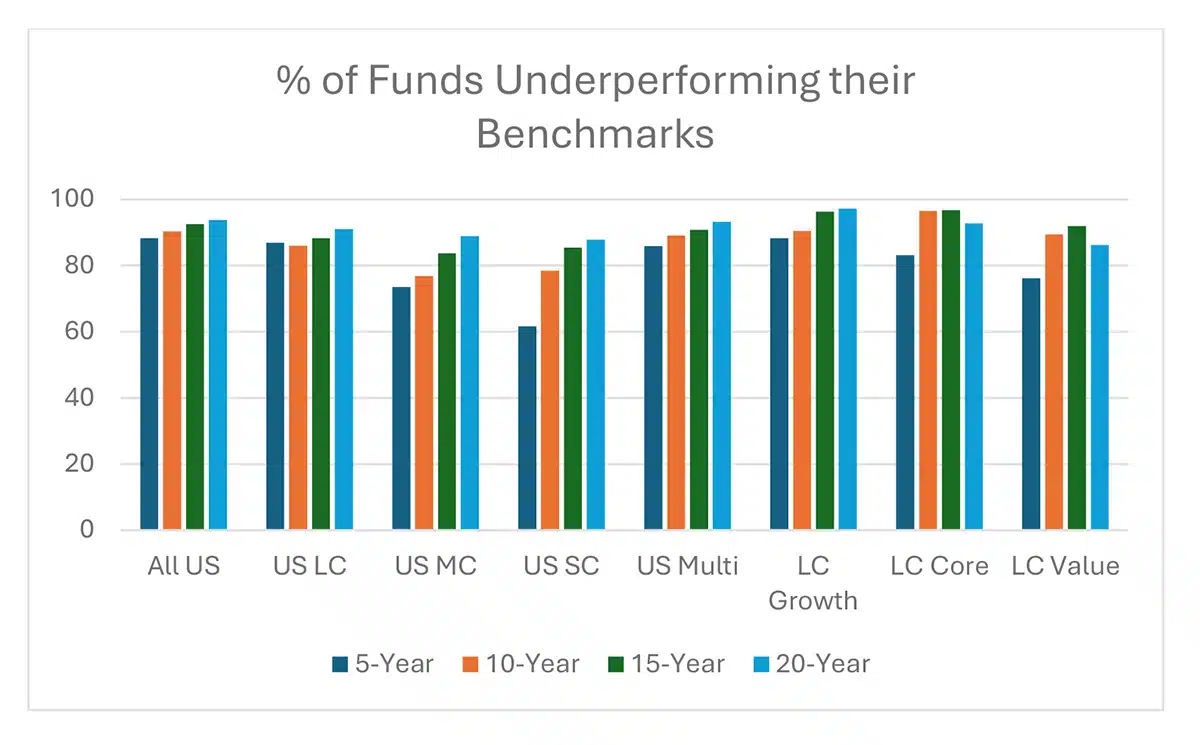

The S&P’s SPIVA (which stands for S&P Indices vs. Active) Mid-Year 2025 report* with returns through June 30, 2025, shows that the vast majority of funds fall short of their benchmarks. Over the past 20 years, the best asset class, Large Cap Value, 86% of funds lagged their benchmark. That is a pretty depressing picture for active management.

OK, so it is hard to beat a benchmark. After all, benchmarks have no trading costs, cash drag, or taxes to pay. So, how much did these funds underperform by? The answer is a lot.

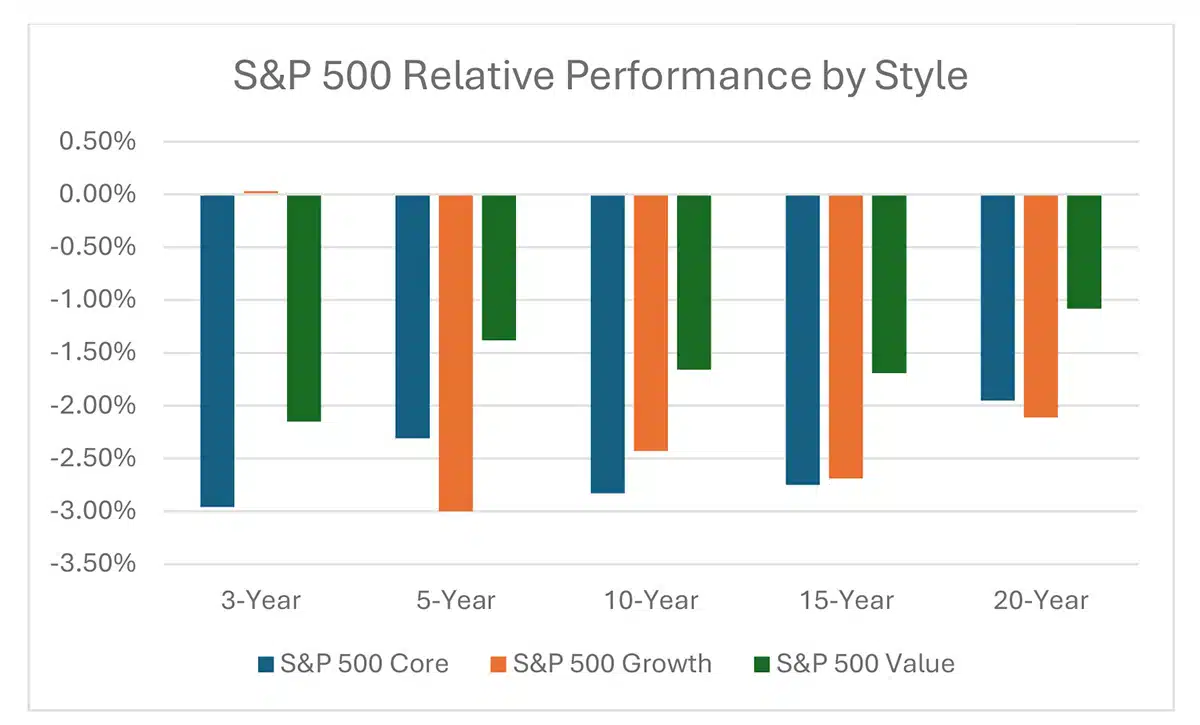

Most every large cap fund underperformed their benchmark by 1% to 3% with the exception of US Large Cap Growth Funds, which marginally beat the S&P 500 Growth Index over the past 3 years. Yes, the S&P 500 is hard to beat because it is covered by scores of analysts and fund managers. What about smaller capitalization stocks where there should be more opportunities to outperform?

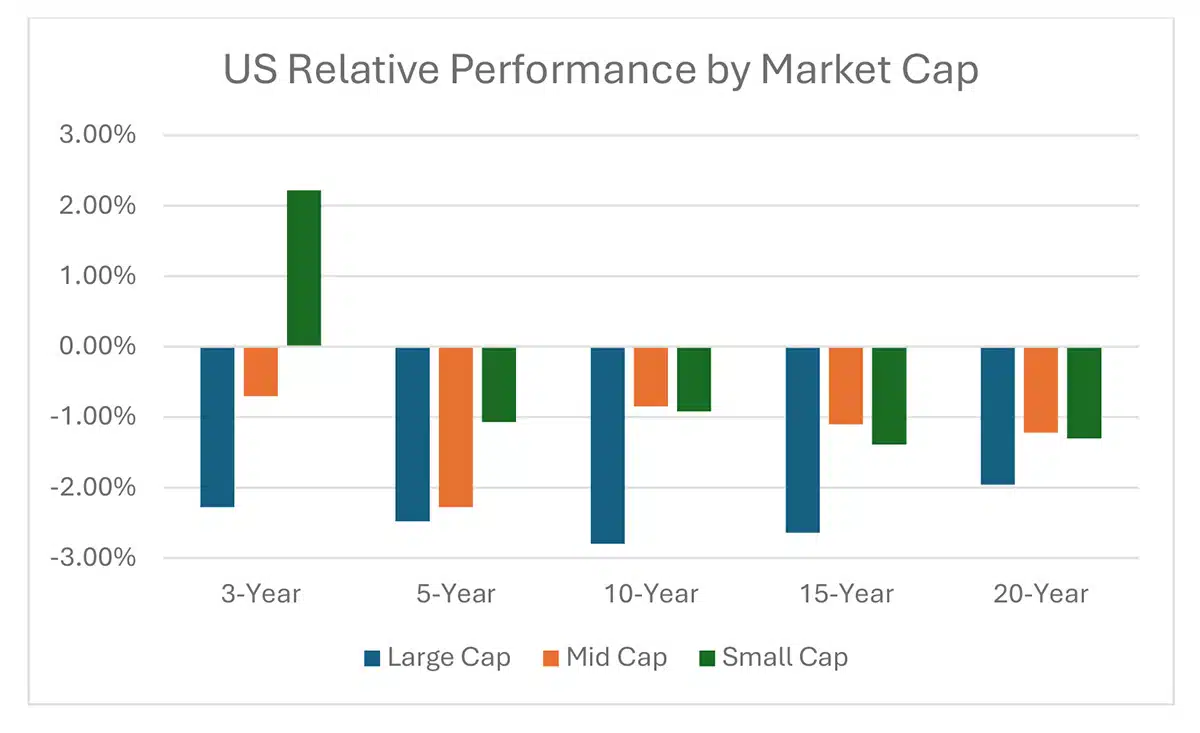

The data does show that Mid and Small Cap managers tend to have better relative performance against their chosen benchmarks, however, they still tend to underperform by 1% or more. Again, except for the 3-year performance for Small Cap stocks, most managers did poorly.

Of course, there are a handful of active managers that do outperform the benchmark from time to time. However, the chances of selecting a superior manager that has staying power is vanishingly small. That is why Vanguard founder Jack Bogle, a big proponent of index funds, famously said “why bother trying to find the needle, just buy the haystack.”

* https://www.spglobal.com/

Explore smarter retirement planning beyond target date funds with a customized glide path built for your goals and risk tolerance.

Thoughtful planning creates confidence. Prepare your finances, career, and family goals for a stronger, more focused 2026.

Before you invest, protect your plan. Discover how Matt Williams uses protection-first planning to build stronger, more resilient financial strategies.

Discover how financial organization and comprehensive planning can protect your family, reduce stress, and create lasting peace of mind.