Investment Planning: Retirement Glide Path

Explore smarter retirement planning beyond target date funds with a customized glide path built for your goals and risk tolerance.

Author: Matthew Williams CFP®, RICP®, CEXP®, CASL®, AEP® | Director of Financial Planning at Impact Advisors Group

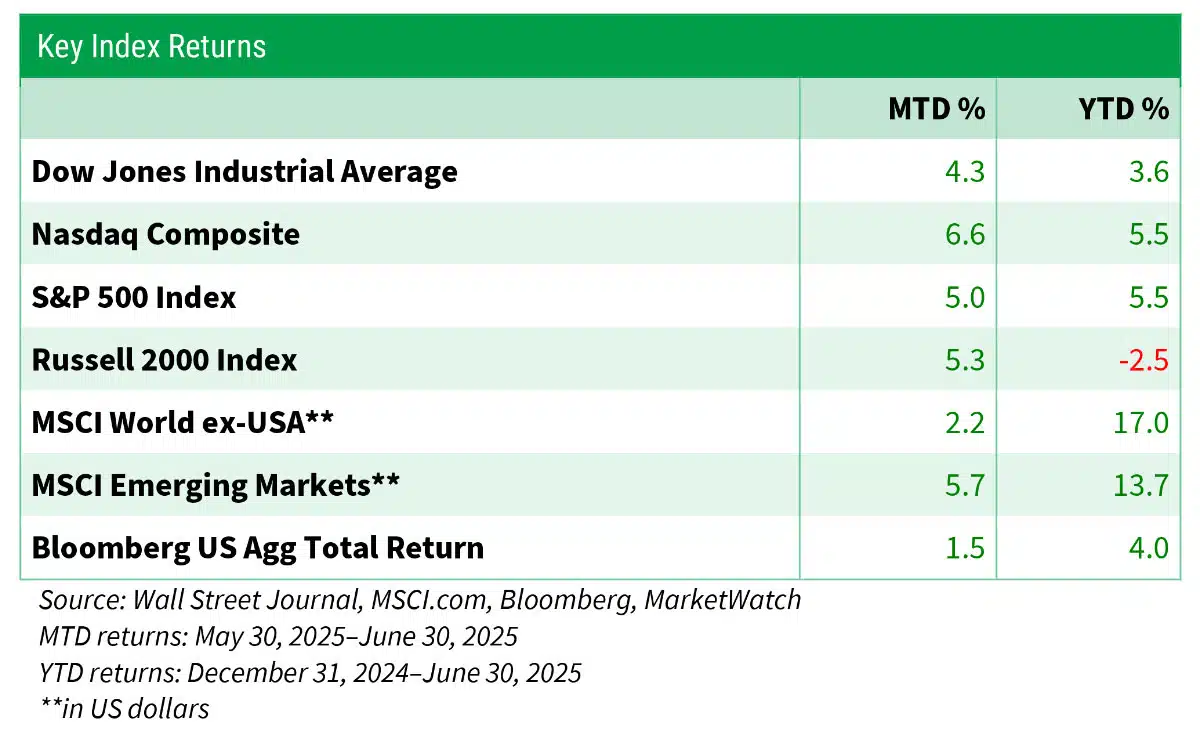

Amid an onslaught of anxieties over tariffs, the economy, and geopolitical challenges in the Middle East, investors brushed aside worries and drove the S&P 500 Index and the Nasdaq Composite to record closing highs on the final two trading days of June, according to data provided by MarketWatch.

A sharp selloff in early April pulled the S&P 500 down 18.9% from its Feb. 19 high, taking the index within just over one percentage point of officially entering bear market territory.

But a 90-day delay in the president’s reciprocal tariffs, a steady economy, stable interest rates, AI-driven momentum, and a buy-the-dip mentality have offset lingering economic and geopolitical fears.

Although trade agreements often require years of negotiation, the optimism among investors on trade and the possibility of progress has also boosted overall sentiment.

Notably, the hostilities between Israel and Iran had only a limited and short-term effect on stocks and oil. Historically, geopolitical turmoil has not significantly impacted U.S. markets, according to data from LPL Research.

Practically speaking, it boils down to whether trouble overseas will affect the U.S. economy. For example, the OPEC oil embargo in the early 1970s exacerbated inflation and contributed to the 1974 recession. And with it, stocks landed in a bear market.

In June, however, Israel’s attack on Iran produced dramatic headlines but had virtually no impact on U.S. economic activity. While tensions are simmering, the swift resolution eliminated a potential headwind.

The swift decline in stocks and subsequent recovery are a stark reminder that successful investors play the long game and avoid timing market volatility.

We recognize the importance of risk management, and your level of risk tolerance influences the suggestions we provide.

However, your financial strategy incorporates unforeseen setbacks—the unpredictable market downturns—that are likely to occur as you work towards your financial objectives.

It may seem like a cliché (and it is), but an old adage deserves to be repeated: “Time in the market, not timing the market,” is the not-so-secret sauce that plays a key role in building wealth.

Patience is a virtue. It’s often the quiet strength behind the most meaningful successes. We see it in the data. Historically, U.S. equities have overcome difficult periods, eclipsing their former highs following a setback.

As we wrap up, let’s look at one dataset. Bespoke reports that the likelihood of the S&P 500 finishing higher on any single day is just 53% (since 1928). Such odds are slightly higher than a coin toss.

Yet, when examining all one-month intervals going back to 1928, the probability of the S&P 500 closing higher after one month increases to 63%. For one-year periods, the index has risen 75% of the time. This figure jumps to 95% over a decade.

Although past performance does not ensure future outcomes, the U.S. stock market has a remarkable long-term track record, and our investing philosophy aims to leverage the positive trend.

In short, patience and the long game have rewarded investors.

I trust this review has been informative.

If you have any concerns or would simply like to talk, please contact me or any team member.

Thank you for choosing us as your financial advisor. We are honored and humbled by your trust.

Explore smarter retirement planning beyond target date funds with a customized glide path built for your goals and risk tolerance.

Thoughtful planning creates confidence. Prepare your finances, career, and family goals for a stronger, more focused 2026.

Before you invest, protect your plan. Discover how Matt Williams uses protection-first planning to build stronger, more resilient financial strategies.

Discover how financial organization and comprehensive planning can protect your family, reduce stress, and create lasting peace of mind.